Indian investors are finally moving from bank fixed deposits, real estate and gold, the traditional investment products, to equities and mutual funds. In FY17, Indians invested Rs.8 lakh crore in stocks compared to Rs.3.4 lakh crore in FDs.

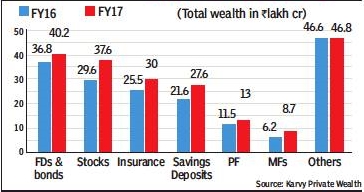

At the end of FY17, total investments by Indians in equities at Rs.37.6 lakh crore was just Rs.2.5 lakh crore short of total FDs, pegged at Rs.40.1 lakh crore. This is the closest that the total equity wealth of Indian investors have ever come to bank FDs, a report by Karvy Private Wealth showed. At the end of FY16, the difference was over Rs.7 lakh crore with Rs.36.8 lakh crore in FDs compared to Rs.29.6 lakh crore in stocks.

The firm believes total investments by Indians in equities will surpass wealth in bank FDs by the end of the current fiscal.