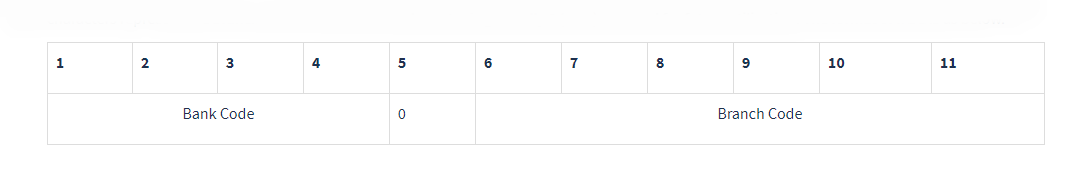

IFSC or Indian Financial System Code is a 11-digit alphanumeric code. It is used to identify the bank and the branch where you have your bank account. The first four letters denote bank name. And the last digits represent the branch details. IFSC is used for doing electronic funds transfer

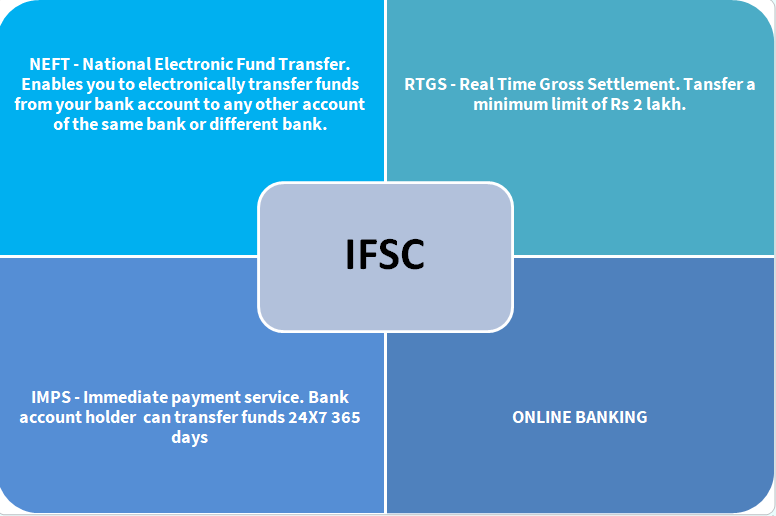

If you want to do electronic funds transfer such as national electronic funds transfer (NEFT), real time gross settlement (RTGS) and immediate payment service (IMPS), you need to have IFSC. If you don’t know your IFSC, you can find it on your cheque book, passbook, the RBI website or online. To find it online, type the name of your branch and bank.

Benefits of IFSC Code

Helps to identify a Bank and its respective branch

Eliminates errors in the process of fund transfer

Transfers done with IFSC such as NEFT, RTGS and IMPS are accurate

The 11 alphanumeric code of IFSC is structured in a pattern where the first four characters representing the name of the bank, while the last six characters represent the branch of the bank. The fifth character is generally 0 (zero) reserved for future utilisation. The format of IFSC is as below.

It is a misconception that IFSC Codes are created by banks themselves. The RBI is the only authority empowered with generating and allotting IFSC to various bank branches through the head office of the banking institution. The RBI maintains a record of IFSC Codes for each bank and branch in India offering online fund transfer facility to the consumers. You can visit the RBI website to get the IFSC Code for your desired bank branch. The link is given at the footer menu on Reserve Bank of India’s home page and clicking on it will take you to a page where you can choose your bank from the drop down menu and type in the branch name to get the code of a specific branch located in India.

It is a misconception that IFSC Codes are created by banks themselves. The RBI is the only authority empowered with generating and allotting IFSC to various bank branches through the head office of the banking institution. The RBI maintains a record of IFSC Codes for each bank and branch in India offering online fund transfer facility to the consumers. You can visit the RBI website to get the IFSC Code for your desired bank branch. The link is given at the footer menu on Reserve Bank of India’s home page and clicking on it will take you to a page where you can choose your bank from the drop down menu and type in the branch name to get the code of a specific branch located in India.

IFSC Codes are unique for every bank and its branch.

RBI has complete authority over the IFSC Codes, from their generation to their alteration and cancellation. It is not usual practice for RBI to change the IFSC Codes for any bank or branch but it the central bank retains the authority to make those changes if necessary. Even if the IFSC Code for anyone’s bank or branch is changed, the new code can be easily obtained from the bank. Account holders should also ask for new cheque books mentioning the new IFSC Code, if there a specific branch’s IFSC has changed.