The first thing that you need to do is to understand what financial independence really is. Essentially, it is the point at which you no longer have to go to work because your passive income from investments, businesses or hobbies are earning more than you spend.

Passive Income > Expenses = Financial Independence

There are 2 sides to this formula: passive income and expenses.

There are many ways to reach financial independence. Here are some wealth generating habits that can make you financially independent:

Avoid high interest debt: Consumer debt is the bane of financial independence. If you use credit cards to buy consumable goods and carry a balance, then you are enriching the banks and not yourself. Credit cards, loans against salary, personal loans and car loans are all examples of money-generating machines for creditors. The first step toward financial independence is to get rid of high interest debts and free your money to work for you instead of the banks.

Ignore the Joneses: One of the many reasons we spend so much money on stuff is to keep up with our friends and neighbors. Is accumulating stuff really the reason we get up every morning to go to work? Most of us don’t need a 3,000 square foot penthouse and luxury cars. A modest home and car will work just as well. Car commercials on TV make life into a competition to buy the most expensive vehicle, but you don’t have to fall for that. Ignore the Joneses to build up your finances instead, and you will leave your neighbors behind financially.

Spend much less than you earn: The real key to financial independence is to spend less than you earn. Avoiding consumer debt and ignoring the Joneses will get you most of the way there, but it takes a lot of diligence to spend much less than you earn. First, you need to track your expenses and see what you spend money on. Then you can cut the things you don’t need and keep lifestyle inflation to a minimum. Of course, it’s equally as important to generate more income. Remember to work both sides of the equation to widen the gap between spending and income.

Pay yourself first: To reach financial independence you will need to put yourself first. You need to prioritize saving ahead of everything else. Save before you pay the utility bills, buy groceries or even pay the rent. Paying yourself first encourages you to live on a smaller budget and it’s a powerful saving habit. Funding your EPF / NPS plan is a great way to get started. The contribution will be deducted right out of your paycheck, so you won’t even miss it. Living with what’s left after paying yourself is a great way to build wealth.

Buy income generating assets: Once you start saving you have to invest the money in assets that will generate income and appreciate. The stock market has a good long-term track record, and many investors build wealth that way. Investment properties, art and collectibles are all assets that will help you move toward financial independence. Focus on buying assets that will make you money instead of depreciating into a pile of electronic junk.

Keep investing: It’s equally important to keep investing over the long term. You have to invest in the stock market though the good and bad years. It can be difficult to buy stocks when the price is going down, but if you don’t, then you will probably miss out on the recovery. It’s much easier to keep buying no matter what the market is doing. That way you’re accumulating wealth over the long haul. As you near retirement, then you will need to adjust your asset allocation to reduce risk and volatility.

Be flexible: Be flexible and adjust your spending accordingly. Some years are bound to be more financially difficult than others, and you need to be able to deal with them. If you’re laid off, then cut expenses and adjust quickly. Don’t wait until you’ve used up your savings before you cut spending. The stock market could plunge 40 percent and reduce your net worth by a huge amount next year. Instead of withdrawing money as usual, another option is to get a part-time job to pull through the rough patch. Being flexible means you’ll always land on your feet and live a less stressful life.

Anyone can take these steps to reach financial independence. Having enough income to cover your living expenses without having to work full time can free you up to actually enjoy your life instead of remaining on a treadmill of working and spending.

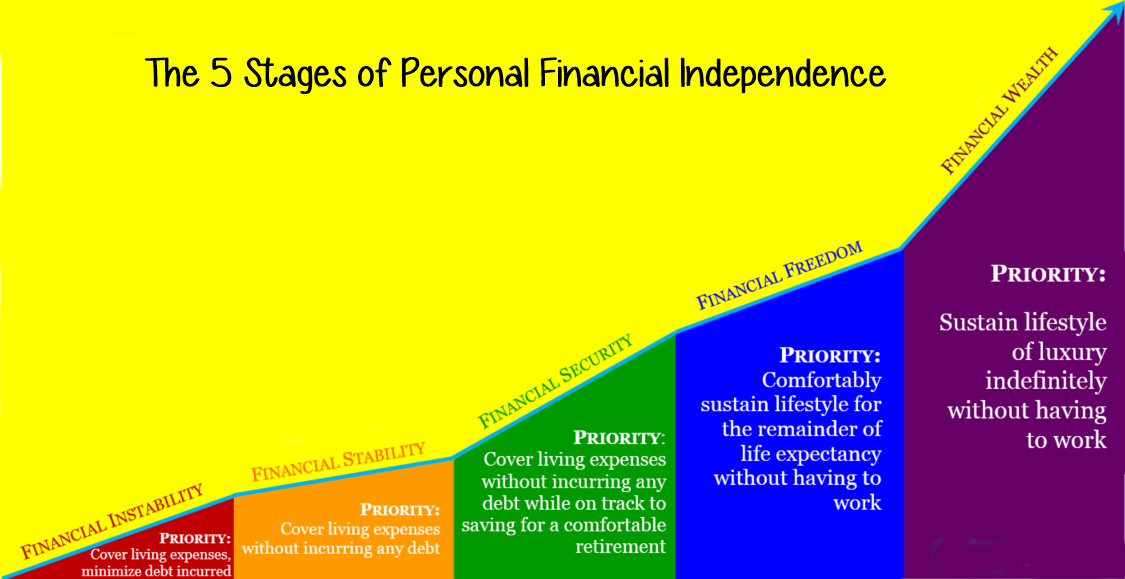

The 5 Stages of Personal Financial Independence

Financial Instability: The stage at which your present income is not enough to cover all of your expenses to live comfortably and you are incurring debt just to cover living expenses. Obviously, the definition of a “comfortable” lifestyle will vary greatly from person to person.

Financial Stability: The stage at which your present income is high enough to cover all of your expenses while living comfortably without having to incur any debt.

Financial Security: The stage at which your present income is high enough to cover all of your expenses while living comfortably today as well as building a comfortable future (i.e. Retirement savings are on track.)

Financial Freedom: The stage at which you no longer are in any debt and no longer have to work to be able to cover all your expenses because you have accumulated enough wealth to sustain a comfortable lifestyle for the rest of your life. Typically achieved at retirement age.

Financial Wealth: The stage at which you have accumulated enough wealth to sustain a lifestyle of luxury indefinitely.