In end-March 2015, Vasant Kamath was feeling restless—he had quit research firm Tracxn with the aim to create a finance product—when he called his friend from IIT Kharagpur Anugrah Shrivastava. Shrivastava was then creating thematic products for institutional investors at Nomura.

Keen to work on their own, Kamath and Shrivastava connected with another IITian friend, Rohan Gupta, a tech expert at Goldman Sachs India. In July 2016, the trio launched smallcase, a platform that offers investors the option of creating, or investing in, theme-based portfolios of stocks or exchange-traded funds.

Some of its earliest themes were GST, affordable housing and digital India—at a time when there were few options in the industry, such as consumption and natural resources. The most popular themes now are all-weather, smart beta, bargain buys and brand value. The Bengaluru-based company, which employs 51 people, has created over 60 portfolios itself, and its users have created about 50,000.

Have you heard of smallcases yet? These are portfolios of equities or exchange-traded funds with an underlying theme or strategy. If you are investing in smallcases, you get the direct ownership of the individual stocks bundled together in a portfolio. This is different from mutual funds, where you don’t have ownership rights in the stocks that form your mutual fund portfolio but you hold units of the portfolio. They might sound a lot like PMS, but unlike PMS, they do not have a ticket size of ₹25 lakh.

HOW DOES IT WORK?

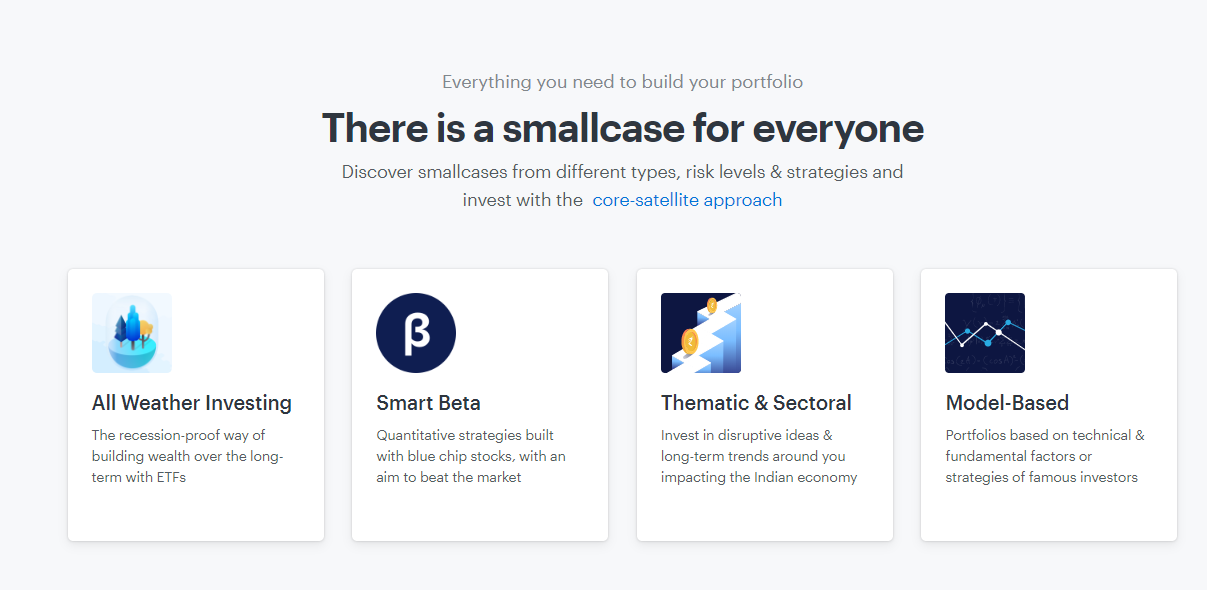

A brokerage account is mandatory to trade in smallcases. Smallcase Technologies has partnered with brokerages such as Zerodha, HDFC securities, Kotak Securities, AxisDirect, Edelweiss, 5paisa and Alice Blue. Since you will be investing in stocks directly, a trading account and a Demat account is required. When you invest in smallcase, money is debited from your trading account and stocks are credited to your Demat account. There is no lock-in period as you hold the stocks directly and they can be sold any time. You can make changes to your portfolio anytime during market hours. There are broadly four kinds of smallcase portfolios. Asset allocation portfolios which are ETF-based portfolios consisting a mix of largecap equities, fixed income, and gold; smart beta portfolio which focus on large cap stocks; model-based that are based on established investment strategies and may have a bias towards mid- and small-cap stocks; and thematic/sectoral. All stocks listed on the NSE are included in the potential investable universe.

THE COST

Standard brokerage charges are applicable depending on the broker you pick. You pay this charge only when there is a transaction and only on the transaction amount, not the entire portfolio. In case of Zerodha, where the standard brokerage is zero, most smallcases have a onetime flat fee of only ₹100. Standard taxes and charges associated with equity transactions will also be applicable.However, no additional fees are required for re-investments, SIPs, to rebalance the portfolio and likewise.

SHOULD YOU INVEST?

You need to have a long-term view towards investing if you want to put your money in smallcases. Most smallcases are designed as long term investment products and may not perform as expected in the short run. If investors don’t have a long term horizon, they should consider alternatives.

However, there may not be a minimum ticket prize since the concept of fractional shares does not exist in India. This can sometimes lead to large minimum investment amounts in instances where stocks like Maruti Suzuki India Ltd or Eicher Motors Ltd [which trade at a high share price of ₹20,350 and ₹6,650 respectively, as of May 8] are included in the smallcase. For readymade smallcases, prior market knowledge is not a pre-requisite as the rebalancing is done by SEBI-licensed research analysts.

Investment in equity funds attracts expense ratio that includes fund management, distributor’s commission and other expenses. This expense ratio is annually deducted from your investment in the equity fund and roughly equates to 1-1.5 percent of the investment.

In comparison, you only pay brokerage for smallcases (after the initial order). smallcases charges no extra investment fee.

While investment in mutual funds gets you fund units, smallcase investment puts shares in your demat account. This is beneficial as the investors get tax free dividend directly in their bank accounts.

smallcase enables you to invest in ideas rather than in stocks based on market capitalisation. For example, one can invest in companies that are working towards affordable housing projects if the focus of the government is on providing affordable housing to all. No equity fund is there that will provide such exposure.

Redemption request with an equity mutual fund usually takes three working days to get processed. With smallcase, an investor can track investments in real-time during the market hours. Request for redemption is also placed in real time as adequate liquidity is one of the stock selection parameters used in smallcases. This, in turn, facilitates quicker redemptions.

It should be noted that the smallcase platform may not be suitable for a first time or new investor, as he or she may not be qualified enough to understand the risks associated with the product. It is advisable to consult a financial advisor before investing via this product.