Despite fall in bond yields, rates have not been cut. The one-year deposit rate has been hiked.

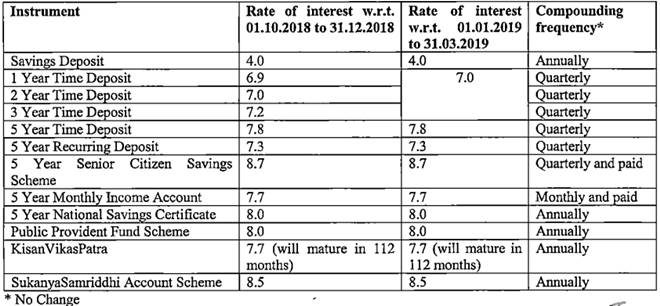

The government has revised interest rates on small savings schemes selectively with effect from 1 January 2019. Following this revision, one-year fixed deposits offered by post offices will fetch higher interest rate while three-year fixed deposits will fetch less interest rate.

One-year, two-year and three-year fixed deposits will fetch an interest rate of 7% for the January to March quarter as against 6.9% for the one-year fixed deposit and 7.2% for the three-year fixed deposit earlier.

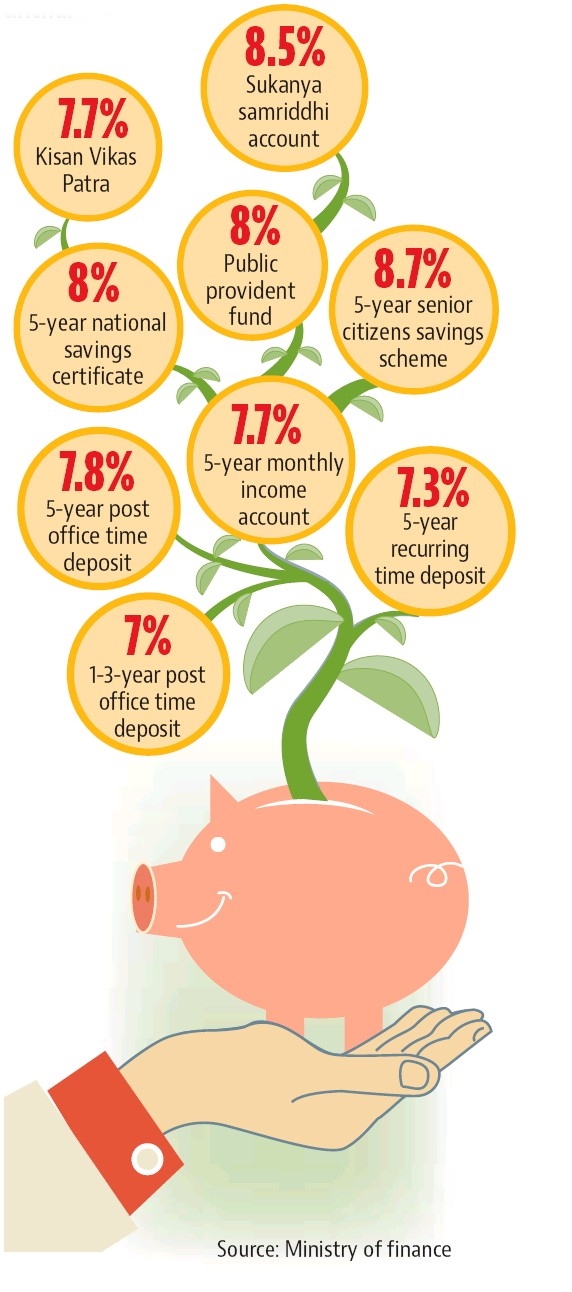

Meanwhile, the interest rate on the popular five year post office recurring deposit has been kept steady at 7.3%. The interest rate on the PPF and the five year National Savings Certificate remains unchanged at 8% while the five-year Monthly Income Account fetches 7.7%. The interest rates on Senior Citizen Savings Schemes and the Sukanya Samriddhi account remain unchanged at 8.7% and 8.5%, respectively, for the January to March quarter.

The government revises interest rates on small savings schemes every quarter. In the previous revision announced in September, interest rates on these deposits were hiked by up to 0.4% for the October-December quarter of last year.

The interest rate on Public Provident Fund, Kisan Vikas Patra, Sukanya Samridhi Account, five-year National Savings Certificate, savings account are compounded annually. On term deposits, the interest rate is compounded quarterly. Small savings schemes are a popular savings tool among the Indians. Individuals having savings of as low as ₹10 per month can save in these schemes.