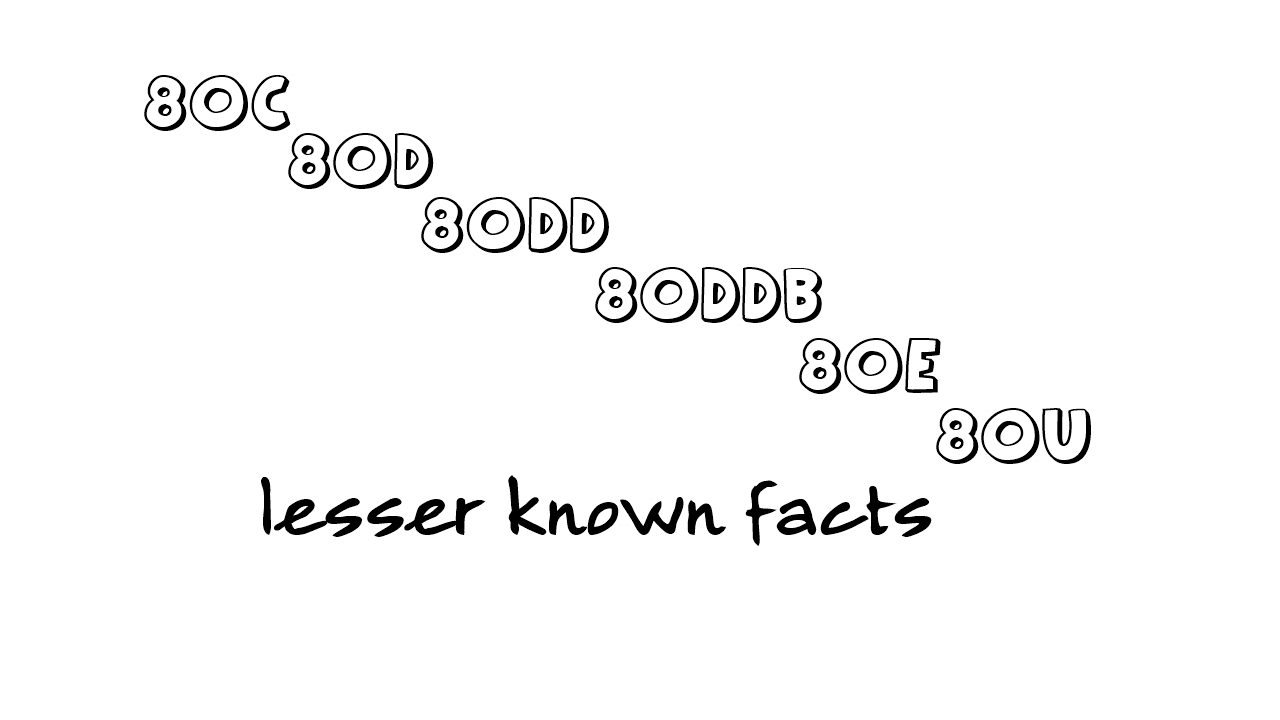

80C: Deductions up to Rs.1,50,000 is allowed in a financial year on the following expenditure or investment made on spouse and/or children:

Tuition fees (excluding development fees, donations, etc) paid at the time of admission or otherwise to any school, college, university or other educational institution situated within India for the purpose of full time education during the financial year for up to two children.

Sum deducted up to 20 per cent from salary payable to government employee for securing deferred annuity or making provision for his/her spouse and children.

Investment in Sukanya Samriddhi Yojana for up to two girl children.

80D: Deductions is allowed up to Rs.25,000 or Rs.50,000 (if you or your spouse is a senior citizen) on amount of health insurance premium paid (in any mode other than cash) for self, spouse and dependent children. An additional deduction for premium paid on parents’ policy up to Rs.25,000 or Rs.50,000 (for senior citizen parents) may also be claimed. Payment to the Central Government health scheme by government employees and/or on account of preventive health check-up up to Rs.5,000 are also eligible for deductions.

80DD: Deduction of Rs.75,000 in respect of (a) expenditure incurred on medical treatment, (including nursing), training and rehabilitation of handicapped dependent relative. (b) Payment or deposit to specified scheme for maintenance of dependent handicapped relative. The handicapped dependent should be a dependent relative suffering from a permanent disability (including blindness) or mentally retarded, as certified by a specified physician or psychiatrist. Further, a deduction of Rs.1,25,000 shall be available under this section, if the dependent is a person with severe disability, with 80 per cent or more of one or more disabilities as outlined in section 56(4) of the “Persons with Disabilities (Equal opportunities, Protection of Rights and Full Participation) Act.”

80DDB: Deduction in respect of medical expenditure for specified diseases incurred is available to the extent of Rs.40,000 or the amount actually paid, whichever is less. In case of senior and super senior citizens, a deduction up to Rs.1,00,000 shall be available under this Section, provided that the expenditure is actually incurred by a resident assessee on himself/herself or dependent relative for medical treatment of specified disease or ailment. The diseases have been specified in Rule 11DD. A certificate in form 10 (I) is to be furnished by the assessee from a specialist working in a government hospital.

80E: Deduction is allowed on payment of interest in the financial year on loan taken from a financial institution or approved charitable institution for higher studies after passing the senior secondary examination or its equivalent from any recognised school, board or university. Deduction under this section shall be available in respect of loan for pursuing higher education by self, spouse or children of the assessee on payment of the interest on the loans over a period of up to 8 years.

80U: Deduction of Rs.75,000 is allowed to an assessee if the assessee himself or herself is a person with disability and in case of severe disability, the deduction allowed is Rs.1,25,000 as per the other conditions u/s 80DD given above.

Allowances: Apart from the above sections, an assessee may deduct from gross salary the following allowances, if availed:

Children Education Allowance: Exemptions are given up to Rs.100 per month per child for a maximum of two children.

Hostel Expenditure Allowance: Exemptions are given up to Rs.300 per month per child for a maximum of two children.