Section 80D: Deduction for premium paid for Medical Insurance

Deduction is available up to Rs. 25,000 to a taxpayer for insurance of self, spouse and dependent children. If individual or spouse is more than 60 years old the deduction available is Rs.30,000. An additional deduction for insurance of parents (father or mother or both) is available to the extent of Rs.25,000 if less than 60 years old and Rs.30,000 if parents are more than 60 years old. For uninsured super senior citizens (more than 80 years old) medical expenditure incurred up to Rs.30,000 shall be allowed as a deduction under section 80D. Therefore, the maximum deduction available under this section is to the extent of Rs.60,000. (From AY 2016-17, within the existing limit a deduction of up to Rs.5,000 for preventive health check-up is available).

Deduction under the above section is available to an individual or a HUF.

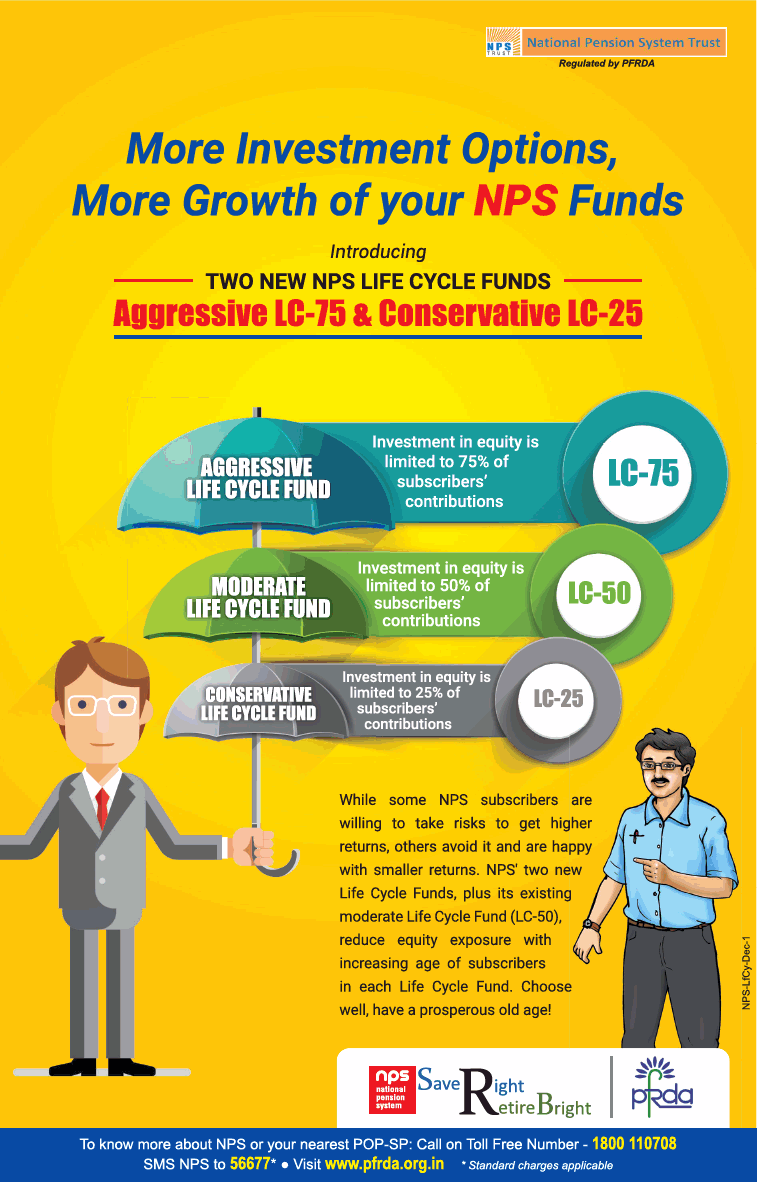

Section 80CCD: Deduction for Contribution to Pension Account

Employee’s contribution – Section 80CCD (1) Allowed to an individual who makes deposits to his/her pension account. Maximum deduction allowed is 10% of salary (in case the taxpayer is an employee) or 10% of gross total income (in case the taxpayer being self-employed) or Rs.1,50,000, whichever is less.

From FY 2017-18 – In the case of a self-employed individual, maximum deduction allowed is 20% of gross salary instead of 10% (earlier subject to a maximum of Rs.1,50,000).

However, the combined maximum limit for section 80C, 80CCC and sec 80CCD (1) deduction is Rs 1, 50,000, which can be availed.

Deduction for self-contribution to NPS – section 80CCD (1B) A new section 80CCD (1B) has been introduced for an additional deduction of up to Rs.50,000 for the amount deposited by a taxpayer to their NPS account. Contributions to Atal Pension Yojana are also eligible.

Employer’s contribution to NPS – Section 80CCD (2) Additional deduction is allowed for employer’s contribution to employee’s pension account of up to 10% of the salary of the employee. There is no monetary ceiling on this deduction.