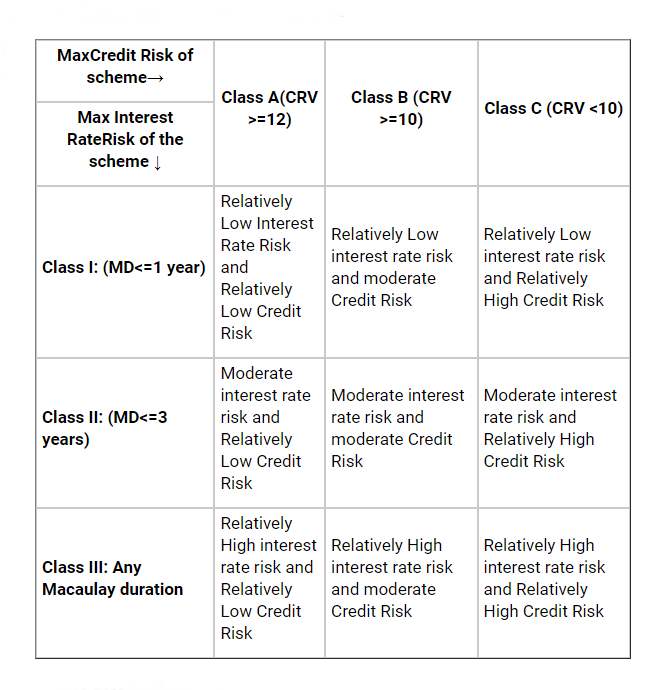

The Securities and Exchange Board of India has directed mutual funds to introduce another label called as potential risk class matrix to help investors assess risk better. At present, MFs have to follow the only the risk-o-meter labelling system.

The potential risk class matrix will consist of parameters based on maximum interest rate risk (measured by Macaulay Duration of the scheme) and maximum credit risk (measured by Credit Risk Value of the scheme). This decision was taken based on the recommendation of the Mutual Fund Advisory Committee and discussions held with the mutual fund industry.

Many in the industry believe the present categorisation of debt funds leave fund managers with a lot of leeway with respect to credit and interest rate risks. They said managers of even extremely safe sounding schemes like liquid funds and ultra-short term funds are free to take credit and interest rate risks.

Fund managers will still be free to take interest and credit risks but they would now have to inform investors beforehand. Investors will have the option to redeem their investments without paying any load in case the risk level goes up.