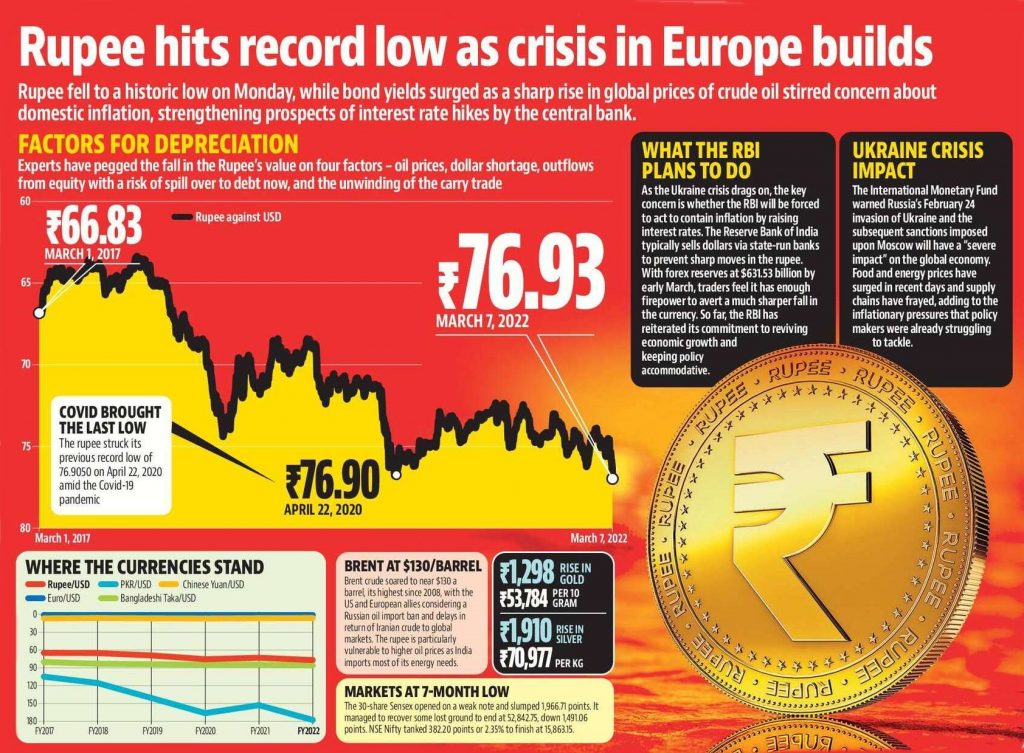

The rupee breached the 77 level against the dollar for the first time as India was seen to be the worst impacted by the crude oil surge in the wake of the Russia-Ukraine conflict. International crude oil prices have shot up nearly 50% from where they were when the government drew up its Budget for FY23. The rise in oil prices is expected to worsen the current account deficit, add to inflation and push up government borrowing, leading to lower growth. India saw a net outgo of nearly $24 billion for oil imports in the third quarter.

The RBI managed to keep the rupee steady at 76. 96 levels for the better part of the day before it briefly crossed 77. It finally closed at 76.97, 80 paise weaker from Friday.

If oil averages around $100 for a prolonged period, the drag on GDP growth could be up to 0. 9 percentage points and inflation could rise by around 1 percentage point, and the current account deficit could widen by 1. 2 percentage points.

While businesses run the risk of costlier inputs, lower demand and higher interest rates triggered by inflation, individuals could see travel and education abroad become costlier. This is a setback to the travel industry, which was expecting some recovery after slowing down in end-December and January due to the Omicron wave.