Investors need to review their equity mutual fund portfolios regularly as the difference in returns between the best and worst performing schemes remain wide. Distributors and financial advisors have been pushing clients to invest in equity schemes through SIPs to meet financial goals such as buying a house, children’s education and retirement.

Many investors have aggressively raised their allocation to equities on the assumption that these schemes would deliver 12-15% every year. But, the track record of the equity mutual fund categories underscores the importance of investors being in the right products.

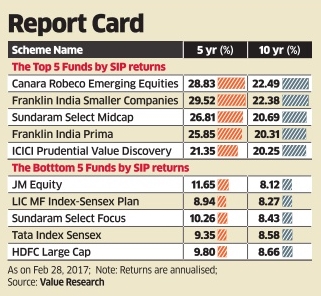

Data from a universe of 202 diversified equity funds, from Value Research, show for a five-year SIP the lowest return was 4.2% while the highest return was 33.74%, and the average return from these funds were at 16.64%. As many as 45 funds delivered SIP returns below 12%.

For a 10-year period, the minimum return was 8.12% with the highest return being 22.49%. For this period, out of 117 funds, 42 delivered less than 12%, with the average returns being 13.61%.

Keeping a track of the portfolio has become all the more important if the current investor interest in domestic equities sustains for a longer period. Big gains from the stock market will be hard to come by as continuous flows into equities will keep stock prices and valuations elevated.

Over the past three years, retail investors have been increasing their allocation to equities slowly through SIPs. A large part of this went into mid cap-oriented equity funds. Monthly SIP collections now stand at Rs.4,100 crore for the industry .

Financial planners point out that it is very important to evaluate your plans and performance of funds regularly . Reviewing your funds once in six months is desirable, but once a year is an absolute must.

While mid-cap and small-cap schemes have been performance toppers over the last five years, financial planners believe, the tide could turn fast, as valuations are considered rich.

In the event of equity investments reaching their targets sooner-than-expected, investors should shift the money to a liquid or debt fund, said advisors.

For example, if you had an SIP running in DSP BlackRock Microcap Fund, which has delivered 32.49% over the last five years, and your goals are met, it would make sense to switch the corpus to a debt fund.

Excerpted from an article by Prashant Mahesh in the Economic Times.