The Reserve Bank of India opened a dedicated bond-buying window for retail investors. Individual savers can now buy and sell bonds through the “Retail Direct Gilt account” at the central bank.

“Retail investors (individuals) will have the facility to open and maintain the RDG account with the RBI,” the central bank said. “RDG accounts can be opened through an online portal provided for the purpose of the scheme.”

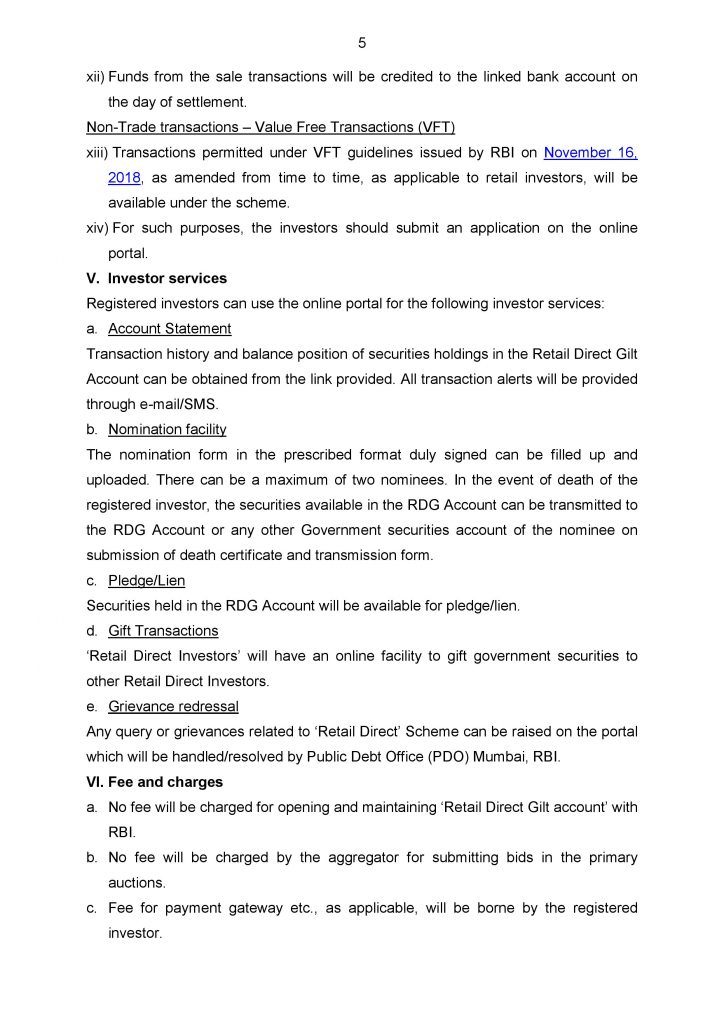

RBI will not charge any fee for maintaining an RDG account. Using the RDG account, a saver can buy from the primary market, which is hitherto dominated by bond houses or institutional investors.

Although retail participation may not change the landscape of the sovereign bond market drastically, this could open a new investment option for savers seeking investment safety and assured returns.

This has come at a time when interest rates have reached a decadal low. This is a positive beginning as individuals will be able to buy sovereign securities across tenors —from less than a week to 40 years.

Investors must have a savings bank account in India, and a Permanent Account Number. A non-resident, too, is eligible provided s/he is compliant with the Foreign Exchange Management Act.

The RDG account can be opened singly or jointly with another retail investor meeting the eligibility criteria, RBI said. Earlier in February this year, the central bank brought in the concept of RBI Retail Direct.