Quant Funds are funds that select investments by using computer based and mathematical quantitative models.

The quantitative models are propriety to the fund house and use data points like PE, PBV, earnings and other ratios to evaluate the stocks with its peers and markets.

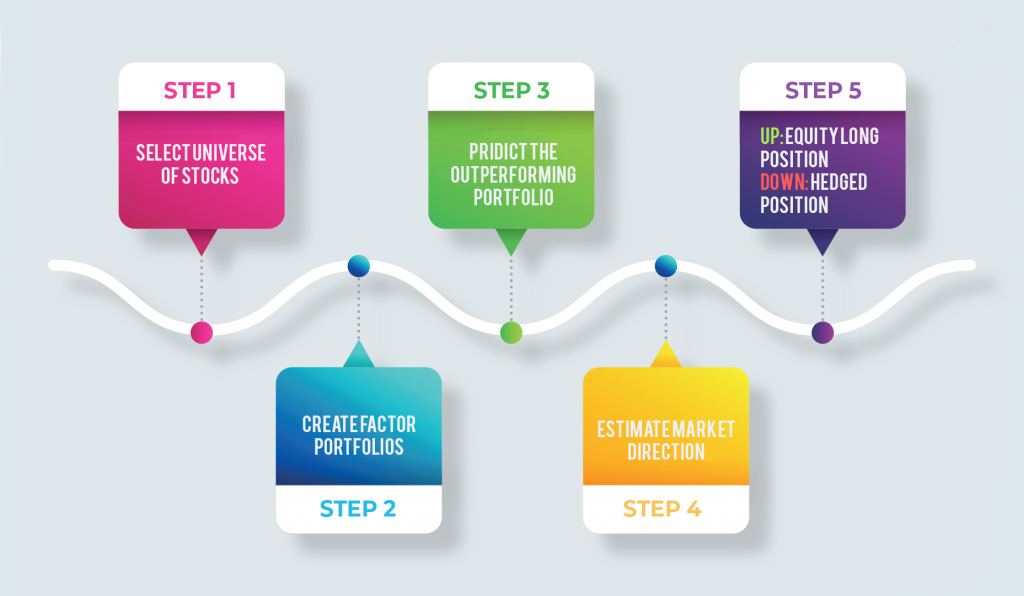

Typically, quant-based schemes have a data-driven approach to pick stocks. They create a stock-picking model using various parameters. The model then selects stocks that match the parameters. The idea is to free stock-picking from human intervention.

In these funds, the fund manager usually focuses on the robustness of the model and keeps a check on whether the model is working optimally or needs tweaking.

Quant strategies, which fall somewhere in between active and passive trading, seek to reduce the role of human bias. They follow a data-driven approach to pick stocks, using pre-defined parameters such as momentum or valuation. Still, their performance globally has been mixed, and greater volatility has made it hard for them to compete with cheaper index funds.

Quant funds may be more suited for long-term investors as it may take time for the strategy to play out in full.

In India, there are a few fund houses offering quant funds like Tata, Nippon and DSP.

With increased data and development in machine learning and AI, quant funds can become groundbreaking in years to come.

The expense ratios of the existing quant funds are between what exchange-traded funds and actively managed funds charge.

Quant funds make sense for savvy investors. Experienced investors can allocate 5% of their equity portfolio to three-four such theme- or strategy-based funds. These could include quant funds and even factor-based ETFs such as those which track Nifty 50 Value 20 index.