The PPF interest rate has been revised downwards to 7.9% wef 01-04-2017.

The PPF interest rate has been revised downwards to 7.9% wef 01-04-2017.

The Public Provident Fund is a government backed small-saving scheme. Here’s what you need to know.

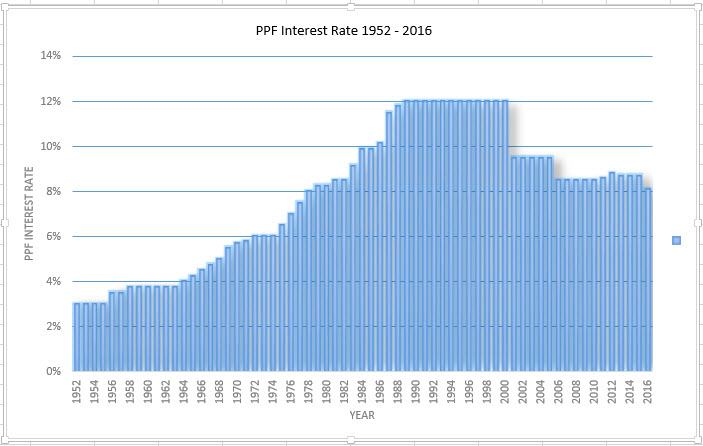

The return is guaranteed but keeps changing. The return is assured but flexible. You are promised a fixed return every year, though the exact figure fluctuates. From 12% p.a. it dropped to 7.9%. The fluctuation is because the rates were fixed annually and benchmarked against the 10-year government bond yield. Now the rates are being fixed quarterly.

Interest is compounded annually, not semi-annually. The interest is compounded on an annual basis and credited to the account on March 31 every year.

Make your investments early in the month. The interest is calculated on the lowest balance between the fifth and the last day of the month. So to maximise your earnings, if you make multiple deposits, ensure that you do them between the 1st and 4th of the month.

PPF ranks the highest in terms of safety. Since the PPF is a government backed investment, it stands for the highest safety.

It is also a very secure investment. The amount in a PPF account cannot be attached under any court order with respect to any debt or liability of the account holder. While it was given to understand that the Income Tax authorities can attach the account for recovering tax dues, the court has ruled otherwise.

You can only have one account. At any point, you are allowed to have only one PPF account in your name. If you are found to have more than one, the second account will be instantly deactivated and only the principal will be returned.

There is no concept of joint account. You can nominate another individual but cannot hold a joint account. You can open an account in the name of a minor child of whom you are the parent / guardian. However, that account will be on the child’s name and you are the guardian.

Make note of the minimum and maximum investments. The minimum you can invest in any single financial year is Rs.500 and the maximum is the limit under Section 80C – which is currently Rs.1,50,000. This limit is not just for your account, but even for the account where you are a guardian. Assume you have an account and your wife has an account. The account in your child’s name has you named as the guardian. In that case, the total amount in your PPF account and your minor child’s PPF account must be a maximum Rs 1,50,000.

Triple tax break: EEE stands for Exempt, Exempt, Exempt: Your investment is allowed for a deduction. So, you don’t have to pay tax on part of the income that equals the invested amount. You don’t have to pay any tax on the returns earned during the accumulation phase. Your income from the investment would be tax-free in your hands at the time of withdrawal.

Long lock-in period. The scheme was promoted to encourage long-term savings, especially for retirement. Hence the lock-in period is 15 years. Although part withdrawals and loans are allowed on completion of a particular number of years, these are available only as a percentage of the total balance.

NRIs: Non-resident Indians cannot open a PPF account. However, if an individual attains the NRI status after the account has been opened and is functional, he can continue with the account till maturity (though the money cannot be repatriated).

HUFs can no longer open PPF accounts.

Mobility is no problem. Individuals can open a PPF account at any branch of State Bank of India, its associated banks, certain nationalized banks, and the post office. ICICI Bank and HDFC Bank also provide this service. If shifting residence, intra city or to another city, the account can be transferred to a bank or “account office” that the account holder chooses.

The Finance Ministry has announced new rules allowing for premature withdrawal of the PPF account deposit for reasons such as higher education or treatment of serious ailments.

The premature withdrawal will, however, be allowed only after the subscriber’s deposit scheme account has completed five years.

A subscriber shall be allowed premature closure of his account or account of a minor of whom he is the guardian on ground that the amount is required for treatment of serious ailments or life-threatening diseases of the account holder, spouse or dependent children on production of supporting documents from competent medical authority.

Withdrawal will also be allowed if the amount is required for higher education of the account holder or the minor account holder, on production of documents and fee bills in confirmation of admission in a recognised institute ..

Also read: https://moneymusingz.in/comparing-ppf-with-elss/