The Reserve Bank of India has increased the limits imposed on peer-to-peer lenders to ₹50 lakh, in a major relief to the fledgling sector. The limit is the total amount of money any investor can invest across all P2P platforms.

Earlier, the aggregate limits for both borrowers and lenders across all P2P platforms stood at ₹10 lakh.

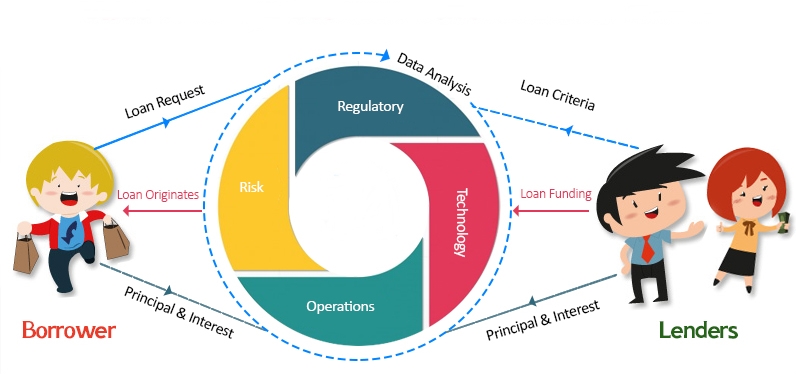

In the P2P industry, individual borrowers are connected to lenders through digital platforms, and the platform just plays the role of a marketplace. More than 15 companies have registered with the RBI as non-banking finance company P2P lending platforms.

The nascent industry has been demanding an increase in the limits for a long time.

The central bank had opened doors to multiple industry representations over the last few months and had even been monitoring the financial performance of every P2P platform closely.

Industry players are also saying they expect venture capital and private equity funding to pick up following the latest announcement. Industry sources said the lower limit earlier was one of the major reasons why investors had been cautious about the P2P space.