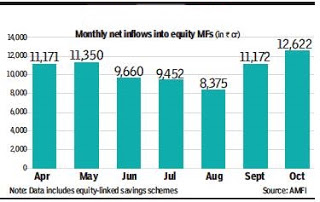

Despite the sustained selling pressure in the equity markets, investors continue to put money in mutual funds. Fund houses received Rs.7,985 crore through SIPs in October — a 42% increase year-on-year.

Net inflows into equity MFs (including equity-linked savings schemes, or ELSS) stood at Rs.12,622 crore in October, a 6.5% improvement over the previous month, according to data with the Association of Mutual Funds in India. Net inflows into equity MFs in October was the highest since February this year. A reduction in redemptions, or investor exits, also boosted inflows in October. Redemptions in equity MFs fell 14% in October on a month-on-month basis.

The benchmark sensex lost about 5%, while the broad-based Nifty fell 5.6% in October.

Retail inflows showed a healthy improvement of almost 30% over last month. SIPs continue to show an upward trend with monthly contributions of Rs.7,985 crore as against Rs.7,727 crore last month. SIPs are done almost entirely in equity funds. The fixed income segment contributes only about 5% in volume terms and about 2% in value terms to overall SIPs.

MFs saw net inflows of Rs.35,529 crore on an overall basis (across all categories) in October compared to outflows of about Rs.2.3 lakh crore in the previous month. The overall net inflows stood at around Rs.51,000 crore in October 2017.

Over the last year, there has been 30% growth in retail folios, 14% growth in retail assets under management and over 40% growth in monthly SIP contributions. The AUM of the MF industry improved marginally on an M-o-M basis to around Rs.22.23 lakh crore in October.