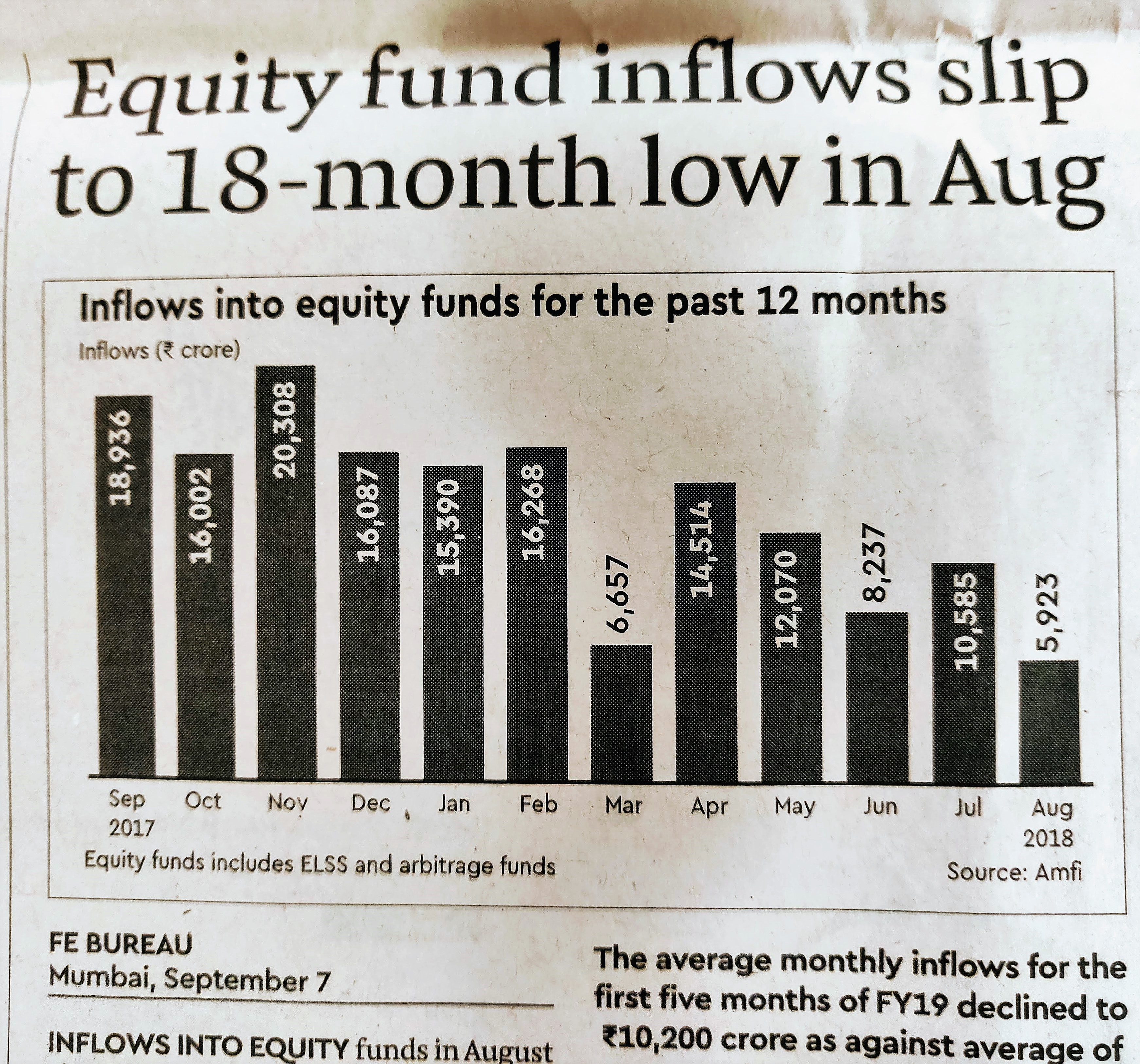

Net inflows into domestic mutual funds slowed down to a five month low in August because of uncertainty in the markets.

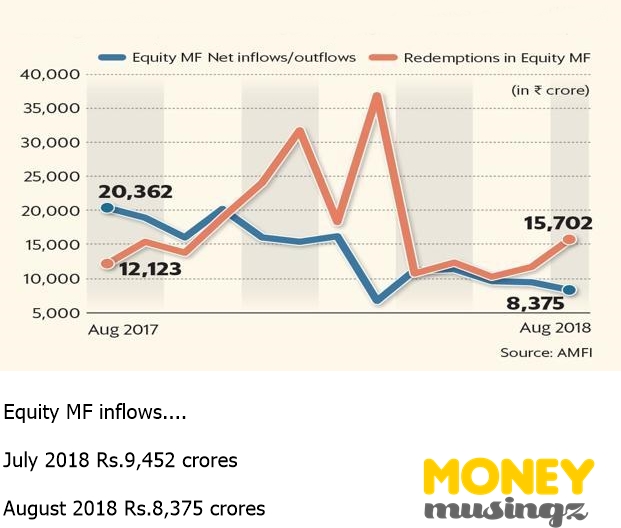

Net equity inflows saw a steady decline, slipping 11.39% to ₹8,375 crore in August. Equity mutual fund schemes saw an infusion of ₹9,452 crore in July.

However, redemption pressures from mutual funds’ equity schemes also increased in August, jumping 35% as investors opted for profit booking with the markets scaling record highs.

During the same period, inflows from systematic investment plans continued to stay robust. The total amount collected through SIPs in August was ₹7,658 crore, as against ₹7,554 crore in July. The total number of SIP accounts at the end of August stood at 23.9 million, against about 23.3 million on 31 July. Net inflows into mutual fund equity schemes saw a steady decline, slipping 11.39% to ₹8,375 crore in August. SIPs allow people to invest a fixed amount in a mutual fund scheme periodically at fixed intervals.

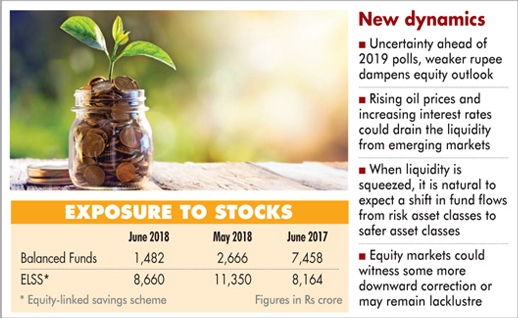

Uncertainty in markets because of macros, politics, a weak rupee and high crude prices were also responsible for lower inflows into equity mutual fund schemes in August. Steep valuations concerns could also be another reason.

So far this year, Sensex and Nifty have gained 10-12%, while Brent crude has climbed 14.45% and the rupee has weakened 11.27%. A few days ago, the rupee slipped to historical low of 72.11 a dollar amid concerns that US President Donald Trump could slap additional tariffs on Chinese goods. So far this year, foreign institutional investors have sold Indian equities worth $305.1 million while domestic institutional investors have bought local shares worth ₹69,878.54 crore.