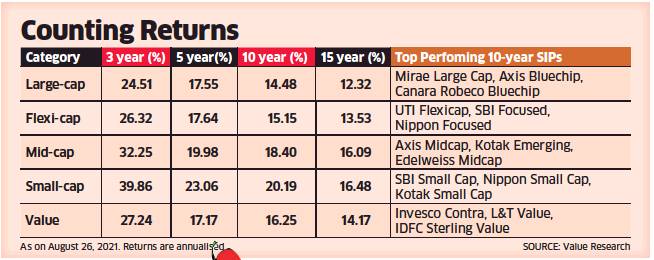

Systematic investment plans in mid- and small-cap funds have made more money for investors than in large-cap, flexi-cap and value-oriented schemes in the past 15 years. According to data from Value Research, schemes that invest in smaller shares have returned almost 40% on a compounded basis in the past three years, 23% in five years, 20% in 10 years and over 16% in the past 15 years.

For example, an SIP of Rs 10,000 every month in SBI Small Cap Fund, the best performer in the category, over a 10-year period, entailing a total investment of Rs 12 lakhs would be worth Rs 46.07 lakh today. In comparison, a similar SIP in a Nifty 50 index fund would be worth Rs 25.97 lakh.

It is not easy to stay invested in small-cap stocks over a long period because of the wild swings. While upsides in smaller shares are sharp, the declines are painful, say wealth managers.

While it is good to see these returns over the long-term, even the best of investors tend to get scared of intermittent volatility in smallcaps and tend to stop their SIPs when returns turn negative. Well known advisers advise an allocation of 30% to mid- and small-cap funds with a holding period of 10 years for those who can bear volatility.

The most recent outperformance of mid- and small-cap funds have been driven by the rally in these shares since March 2020. In the event of a market sell-off, these shares appear most vulnerable to sharp declines, said fund managers.

They believe there is still scope for fund managers to generate better returns in mid- and small-cap funds. According to SEBI categorisation, small-cap funds have to invest a minimum of 65% into stocks that have a rank above 250 in terms of market capitalisation.

Shares of many of these companies are under-researched and pick up activity only in a bull market. A report by Edelweiss Mutual Fund points out that the average number of analysts covering large-caps are 31 and midcaps 18. In the BSE Small Cap index, 203 stocks are not covered by any analysts and 273 stocks are covered by less than 5 analysts.

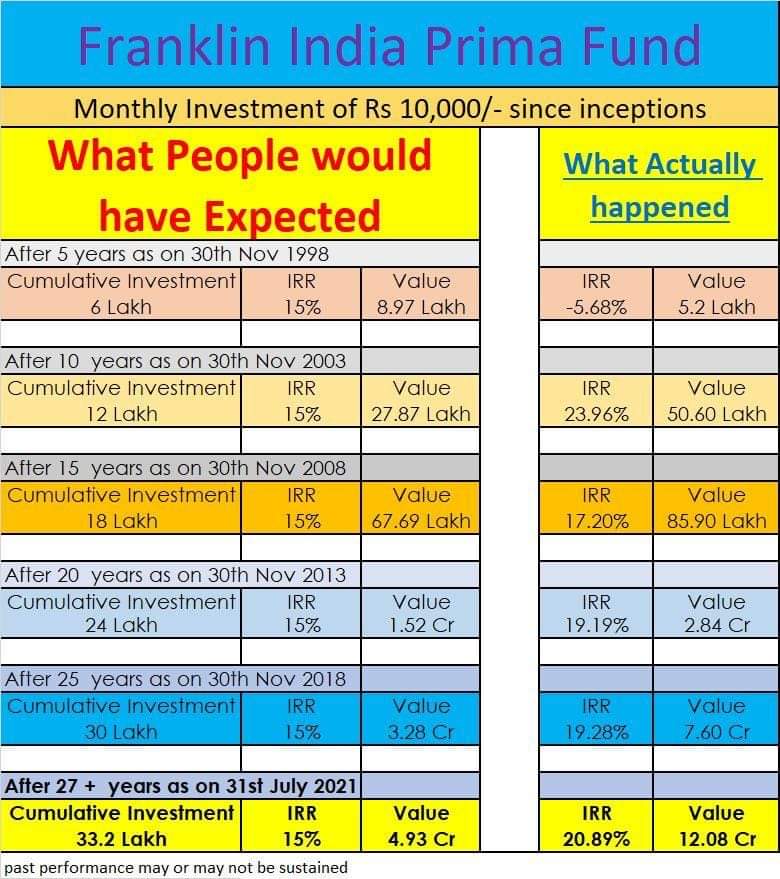

Take the example of Franklin India Prima Fund, one of the oldest mid-cap funds….