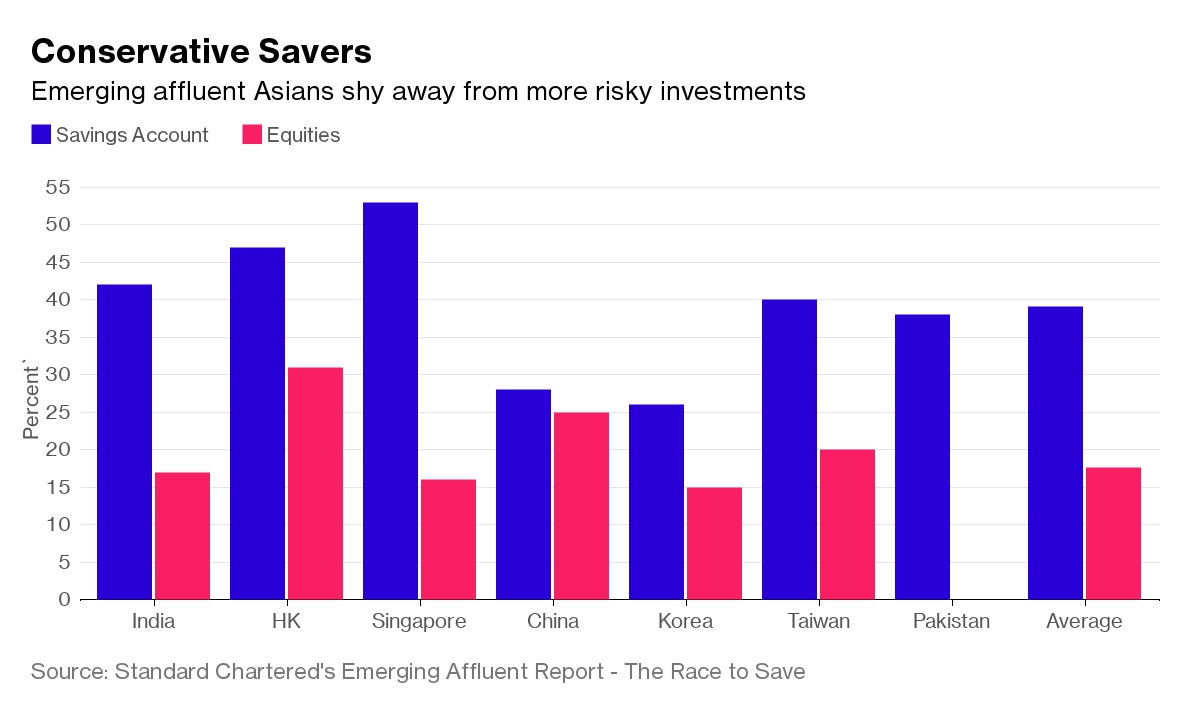

Asia’s legendary savers are missing out on greater wealth by being too conservative, according to a study by Standard Chartered Plc.

An average of 39 percent of “emerging affluent” individuals in seven Asian countries rely on savings accounts to meet their top savings goal, while just 18 percent use investments in equities, according to figures in the survey.

The most extreme example of a cautious approach to saving came from Pakistan, where some 50 percent of those surveyed said they keep their savings at home in cash, avoiding the banking system altogether, according to the report.

Banks from Standard Chartered to HSBC Holdings Plc are seeking to tap into burgeoning middle-class wealth to revive earnings hobbled in recent years by mounting capital charges as well as regulatory and legal costs.

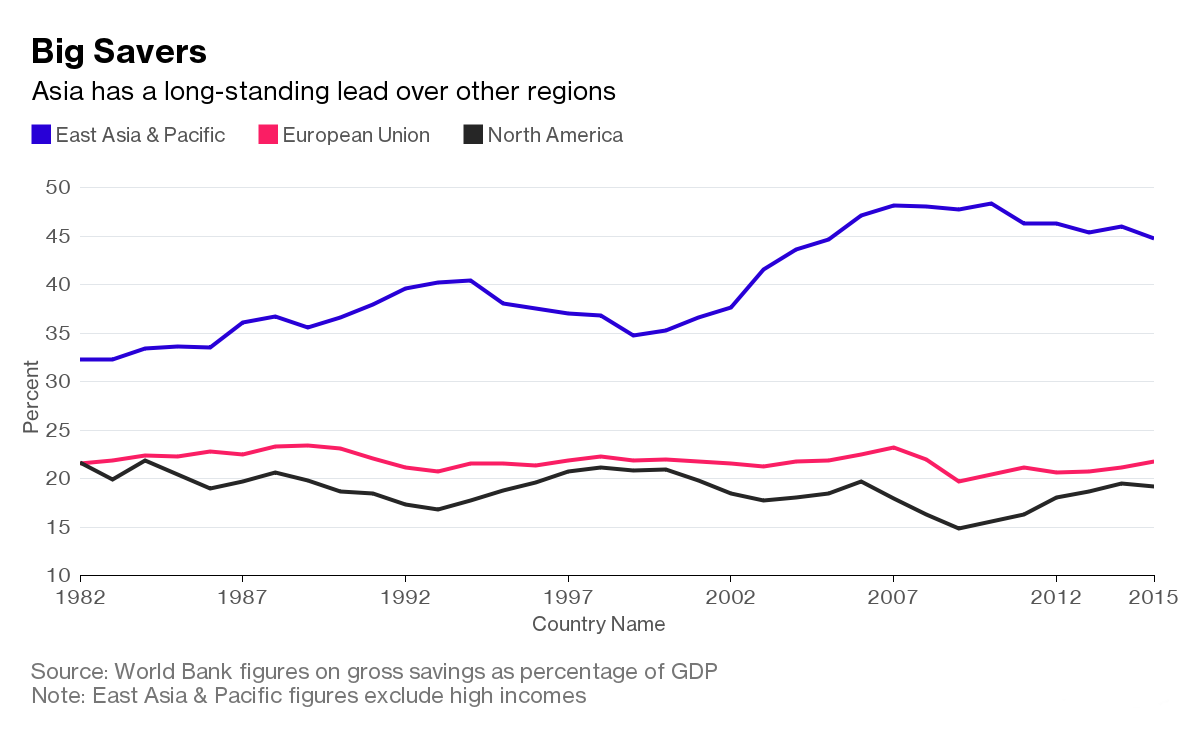

Gross savings in East Asia and the Pacific amounted to 45 percent of the region’s gross domestic product in 2015, more than 22 percent for the European Union and 19 percent in North America, according to World Bank figures.

Different income ranges were applied to the Asian countries in the Standard Chartered study, which was conducted by research firm GlobeScan. Respondents from China, for example, came from households with gross monthly incomes of between 20,000 yuan ($2,900) and 40,000 yuan, while in Singapore, the range was S$5,000 ($3,580) to S$16,000.

Emerging affluent is defined as a consumer class that is able to set aside money each month to build savings for future goals. By switching from a mostly basic savings approach to a “low-risk wealth management investment strategy,” savers in these markets could boost their returns over a 10-year period significantly, for example by as much as 86 percent in Hong Kong.