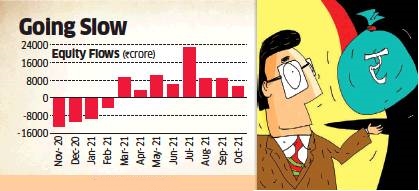

The pace of flows into equity mutual funds slowed down in October as investors concerned over the run-up in the stock market held back some of their fresh investments.

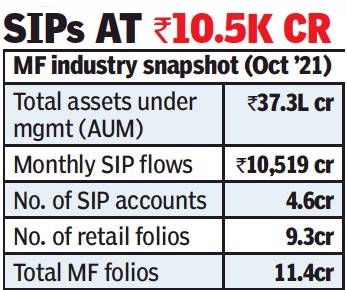

Equity schemes received ₹5,215 crore in October as against ₹8,677 crore the previous month. Mutual funds’ total assets under management edged up to ₹37.56 lakh crore from ₹37.4 lakh crore in the previous month as corporate investors allocated surplus money to debt products at the start of the new quarter.

In equity, retail investors continued to allocate money through the monthly investment route. Systematic investment plan or SIPs collected ₹10,519 crore in October, compared to ₹10,351 crore the previous month.

Many individual investors continued to prefer balanced advantage funds — a product category that puts money in stocks and debt — over plain-vanilla equity products. This category saw inflows of ₹11,219 crore, with about ₹5,300 crore coming from the new fund offer of NJ Balanced Advantage Fund.

Arbitrage funds — a low-risk product seen as a substitute for safe debt funds that has been in demand recently — saw outflows of ₹2,344 crore in October, as returns dwindled to 3%, prompting investors to switch to other hybrid categories. Equity savings funds and conservative hybrid funds that allocate between 10-40% to equities saw inflows of ₹967 crore and ₹406 crore, respectively.

Within equity schemes, thematic and flexi-cap funds continued to draw investor attention, garnering ₹1,733 crore and ₹1,122 crore, respectively. Financial planners prefer the flexi-cap schemes among equity product categories as they give fund managers flexibility to allocate across large, mid and small-cap stocks.

Within the debt mutual fund categories, investors continued to move money out of liquid funds due to the seven-day lock-in and shifted to overnight, ultra-short and low duration bond funds. These three categories saw inflows of ₹15,000 crore.

Floater funds received flows of ₹5,050 crore, as they are seen as a hedge against rising interest rates.