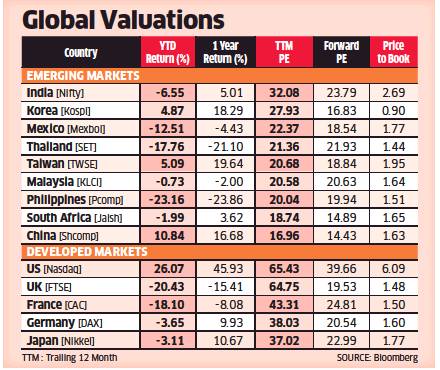

The record-high valuation of the Nifty will be pushed further up following the inclusion of Divi’s Laboratories and SBI Life Insurance in the index later next month. The price to earnings ratio — a popular valuation matrix — of the Nifty was at 32.08 times, making India’s main index the most expensive among its emerging market peers.

After Divi’s and SBI Life are included, the index’s PE would advance to 32.68. Both the stocks will be included in the index on September 25. The two new entrants Divi’s Laboratories and SBI Life Insurance are currently trading at PE ratios of 61.73 times and 62.89, respectively. The PEs of the outgoing stocks — Zee Entertainment and Bharti Infratel — are at 35 and 11.87 times, respectively.

After India, the second-most expensive emerging market is South Korea, which trades at 27.93. Mexico commands a PE of 22.73.

Indian equities have become one of the most expensive among emerging markets after the 50% rally in the Sensex and the Nifty from their lows of March 23. The sharp cuts in earnings estimates following the June quarter results also pushed up valuations.

On an FY21 estimated earnings basis, Nifty’s PE ratio will likely go up to 24.15 times from 23.79 following the changes in the composition.

The Nifty trades at an estimated PE ratio of 23.79, which is at a 39% premium to the 10-year average PE of 17.11.