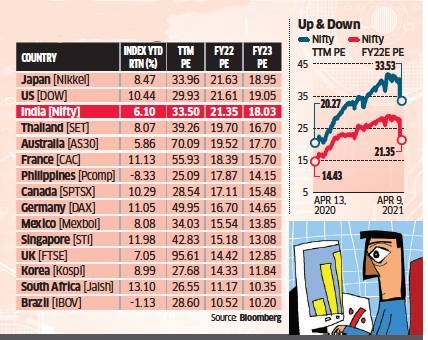

Valuation of India’s key benchmark has shrunk following the NSE’s move to change the calculation methodology and the decline in the market in the past month. The Nifty’s Price to Earnings ratio — a popular valuation measure — based on 12-month earnings has declined nearly 20% from a March high of 41.60 to 33.5. The NSE decided to consider consolidated earnings to calculate PE ratio from March 31. This has resulted in Nifty’s PE ratio based on earnings estimates decline 26% from a March high of 29 to 21.35. The change in calculations have made Nifty’s valuations cheaper, but they are still higher than the regional peers.

The 50 companies comprising the Nifty have reported a consolidated net profit of ₹3.4 lakh crore for the trailing 12 months ended December 2020, which was nearly ₹55,000 crore more than their standalone net profits. Earlier, the NSE did not consider consolidated earnings of conglomerates such as Reliance Industries, L&T, HDFC and State Bank of India among others which have multiple businesses. For instance, RIL with businesses like telecom and retail reported consolidated profits of ₹45,290 crore compared to its standalone figure of ₹27,048 crore. Firms like HDFC, Grasim and Bajaj Finserve too have reported consolidated profits ₹6,000- 8,000 crore more than their standalone profits.

The exchange in February announced that index PE ratio will be calculated by taking into consideration earnings, including profits and losses, reported by each index constituent in the trailing four quarters on a consolidated basis effective from March 31.

“Sectors with high weights like financials, FMCG, IT and pharma have already witnessed strong earnings growth and ensuing recovery will also be strong and consistent going into FY22-FY23, which would then help sustain premium valuations multiples and hence the higher orbit of Nifty PE,” said Pankaj Pandey, head of research, ICICI Securities.