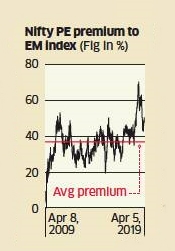

For months, India remained significantly costlier than its emerging market peers, reflecting the theoretical upside limit to local stocks. With the Federal Reserve turning dovish, money began flowing into emerging market equities that posted their best quarterly gains in the past two years in the March quarter.

Indian equities expanded more slowly. The valuation premium of the Nifty 50, compared with the MSCI EM index, dropped to 47% from the 15-year high of 70% in September 2018. The long-term average valuation premium to the MSCI EM index stood at 33%. The relative valuation of the Nifty 50 eased after it underperformed the MSCI EM index by 5% since the beginning of the year.

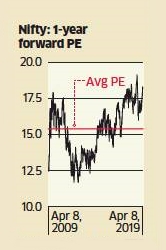

However, on an absolute level, the valuation of Indian equities continues to remain elevated. The Nifty, trading at 18.7 times its projected twelve-month earnings, is the most expensive among the top 20 by market capitalisation. The Nifty is trading at a 17.7% premium to its long term average. There are 15 companies in the Nifty 50 trading at premiums to the benchmark. The prominent companies with superior valuation are Titan, Asian Paints, Britannia, HUL, and Bajaj Finance.

On price-to-book value terms, the Nifty is trading at 2.66 times against the ten-year average of 2.40. On EV/EBITDA basis, it is trading at 10.37 times, a 7.3% premium to the long-term average. Market cap to GDP ratio —a measure often used by long-term investors —stood at 83% compared with a 10-year average of 79%. The market cap to GDP ratio peaked at 146% in the previous bull phase of 2007.