FMPs are closed-ended debt funds with a maturity period that can range from one month to five years. Because debt funds enjoy long-term capital gains tax after three years, typically three-year FMPs are now popular. FMPs are predominantly debt-oriented, and their objective is to provide steady returns over a fixed-maturity period, thereby protecting investors from market fluctuations.

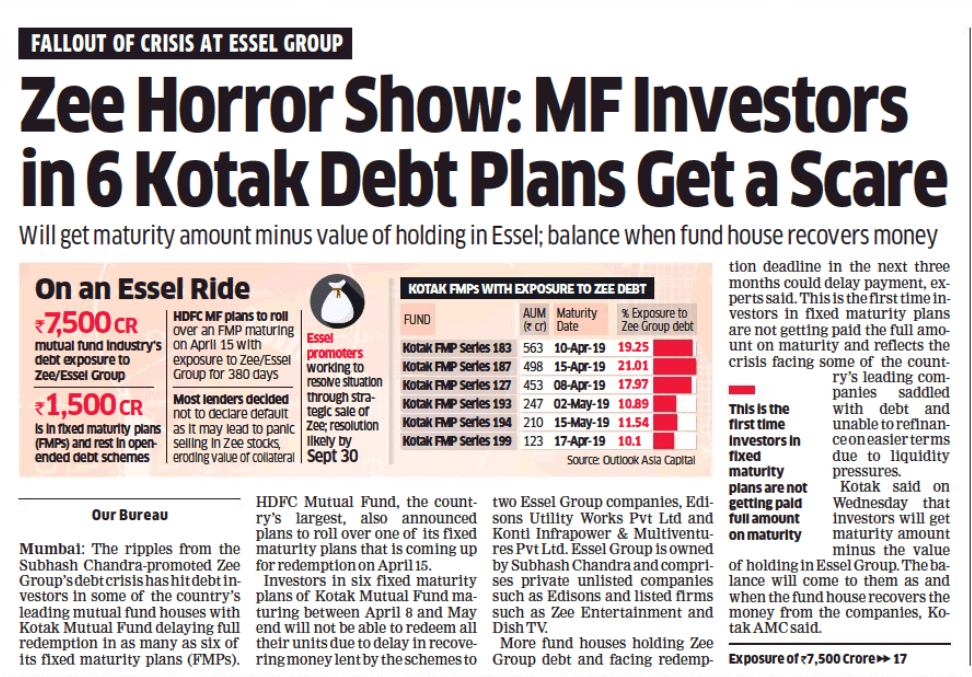

A few FMPs holding paper of Zee/Essel Group have come up for maturity starting April 8. On maturity, these schemes should pay back full amount to investors which includes principal plus earnings on the portfolio. However, since these FMPs have paper belonging to Zee/ Essel Group in their portfolios, one fund house is repaying investors money minus their holding in Zee/Essel paper. Another fund house has proposed to rollover its FMP by a period of 380 days.

An FMP portfolio consists of various fixed-income instruments with matching maturities. Based on the tenure of the FMP, a fund manager invests in instruments in such a way that all of them mature around the same time. During the tenure of the plan, all the units of the plan are held until they mature on a specified date. Thus, investors get an indicative rate of return of the plan.

FMPs usually invest in certificates of deposits (CDs), commercial papers (CPs), money market instruments, non-convertible debentures over a defined investment tenure. Sometimes, they also invest in bank fixed deposits.

Since FMPs are closed-ended funds, they can only be traded on the stock exchange where they are listed. However, trading in these units is negligible which makes FMPs illiquid. Compared to this, open ended debt funds can be bought or sold on a daily basis.

Since FMPs invest in debt instruments, they provide low risk of capital loss as compared to equity funds. Since the securities in the portfolio are held till maturity, FMPs are not affected by interest rate volatility.

FMPs offer better post-tax returns than FDs as well as liquid and ultra short-term debt funds because they offer indexation benefits. Indexation helps to lower capital gains and thus lower the tax. Triple indexation allows an investor to take advantage of indexing his investment to inflation for 4 years while remaining invested for a period of slightly more than three years.

Since these instruments are held till maturity, there is a cost saving with respect to buying and selling of instruments, thereby resulting in a lower expense ratio for investors.

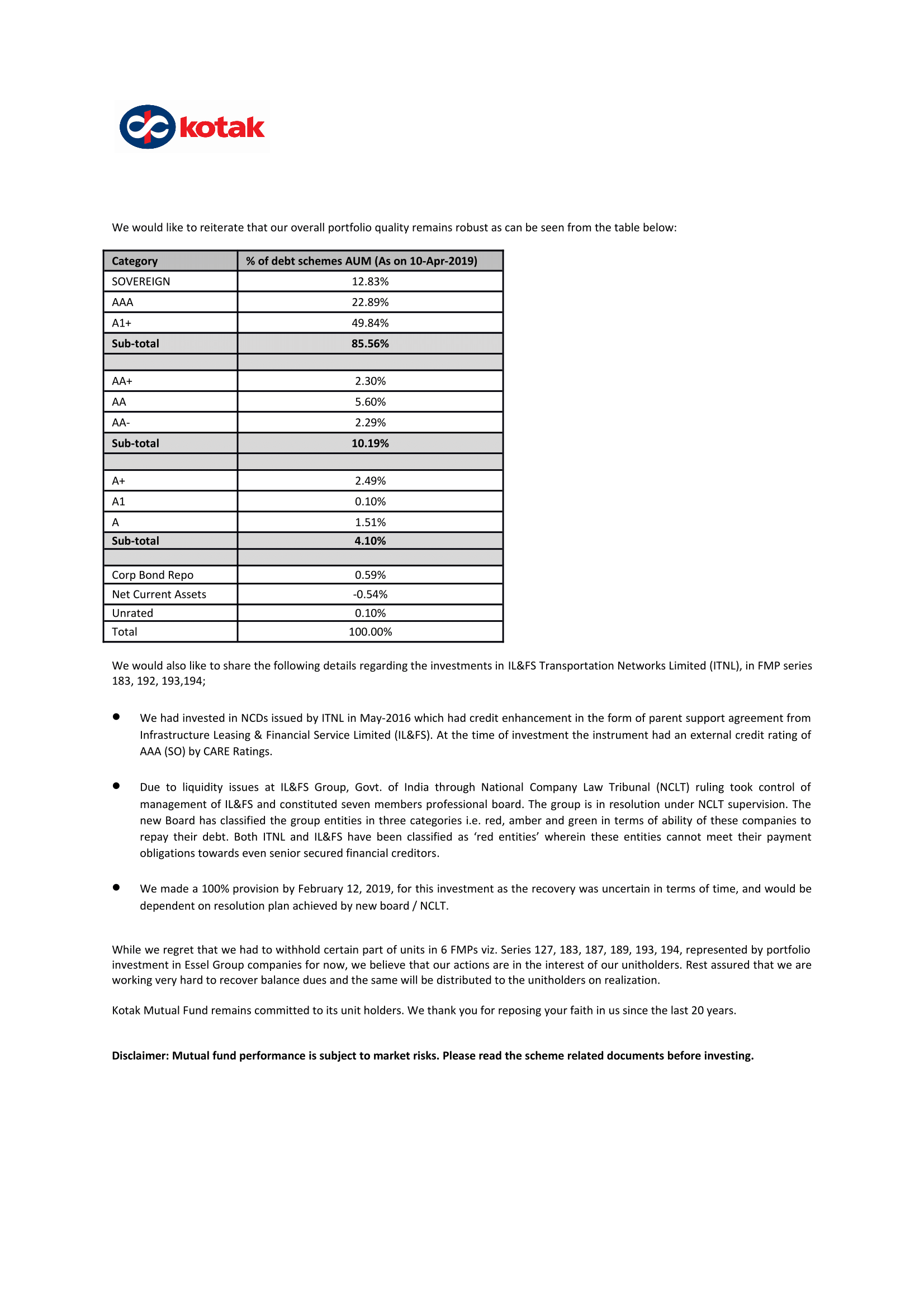

Investments are fundamentally of two types: fixed income and equities (stocks and equity schemes of mutual funds). Everybody knows that equities are risky but they create wealth because the returns from well-chosen equities are much higher. Fixed-income products offer lower returns and, to compensate for that, they are less risky. This is why it is commonsensical to take risks in equities but not in fixed–income investments; it would be stupid to take higher risks with low returns.

The safest debt instruments are bank deposits of scheduled commercial banks. But the interest income is taxed above a small threshold. So, post-tax returns of bank deposits are low. This is where debt schemes of mutual funds are attractive. They are taxed differently and, hence, they offer a higher post-tax return, especially to those who are in the highest tax bracket. Most people fall for this small additional return, without understanding the risks.

Credit Risk: This is the risk of default on a debt obligation that arises mainly when the borrower fails to pay the interest or repay the principal at the predetermined date.

Interest Rate Risk: This is the risk of fluctuation in the price of the debt securities in the event of change in interest rates. The fluctuation varies depending on the maturity period of the debt and the interest rate it offers.

Liquidity Risk: The risk that the scheme will not be able to sell its investments without affecting its market price.

In January 2019, the share price of listed Essel group companies (Zee Entertainment, Zee Learn, Essen Packading and Dish TV) nosedived amid controversies and financial troubles emerging in an unlisted infrastructure company Essel Infrastructure. The promoter Subhash Chandra had borrowed heavily from AMCs and other investors, using his stake in the group’s publicly-listed firms as collateral to raise such vast sums.

The debt, secured against the promoters’ shares, proved insufficient for margin requirements after the stock prices fell sharply. Creditors, including AMCs, that had lent to Essel against its pledged shares, tried to sell shares to recover their money. But, this went badly as the share price tanked even further.

After personal meetings, and guarantees made by the promoter, AMCs signed what is called ‘standstill agreement’, not to sell shares. Additional premium over the principal and interest amount on the debentures is also on the cards, if Mr Chandra can fulfil his debt obligation by 30 September 2019.

AMCs have a credit risk on their hands and are hoping that Mr Chandra will come good. Hope is not a strategy; this is credit risk in action.

Lessons that we can learn from this crisis….

Lesson 1: Debt schemes take a different kind of risk with your money which is far more than normal risks like credit risk, interest rate risk and liquidity risk. Yes, it is equity risk!

Lesson 2: Imprudently large exposure to a few highly risky securities is another risk that all debt schemes can be exposed to.