1: Don’t Look Rich – Become Rich

Rather than actually building wealth, people tend to spend their money on things that elevate their social status.

Whether expensive 🚗, designer 👗, exclusive restaurants, or the latest iPhone, a lot of money is wasted on showing off to others.

If you want to build wealth, you’ll have to stop playing status games and start playing the wealth game. But status and wealth often get confused with each other. That’s because status symbols – sports cars, designer clothes, fancy watches are visible, flashy, and tangible.

We can see and touch these things. But symbols of true wealth tend to be invisible to the outside world. Unless you show your bank or investment account, no one can see how wealthy you are. It’s much less flashy.

People playing status games spend their money on looking rich. People playing the wealth game spend their money on actually becoming rich. True wealth tends to be silent, under the radar, and much less visible.

In other words, building true wealth requires being less flashy. It requires not playing status games. It requires caring less about what other people think of you.

2: Invest in Yourself

Investing in yourself – your skills, knowledge, and network has the highest return on investment compared to most fin. assets When you increase your skills and build your network, becoming wealthy is no longer about luck it’s a logical long-term outcome.

▪️One practical tip from an online course could make you an extra $1000 per month

Investing in yourself pays some of the highest dividends.

3: Be Financially Literate

Building wealth isn’t necessarily about making a lot of money — it’s about mastering your money.

People who make a lot of money without having learned the financial foundations tend to quickly spend (or lose) their money.

Statistics show 706 of lottery winners end up broke and 33% go on to declare bankruptcy within 7 years after winning the lottery.

And many professional athletes and famous entertainers who made millions in their careers ended up bankrupt too:

These examples show that even if you’ve made hundreds of millions, you can still lose it all when you lack financial literacy.

“Money without financial intelligence is money soon gone.”

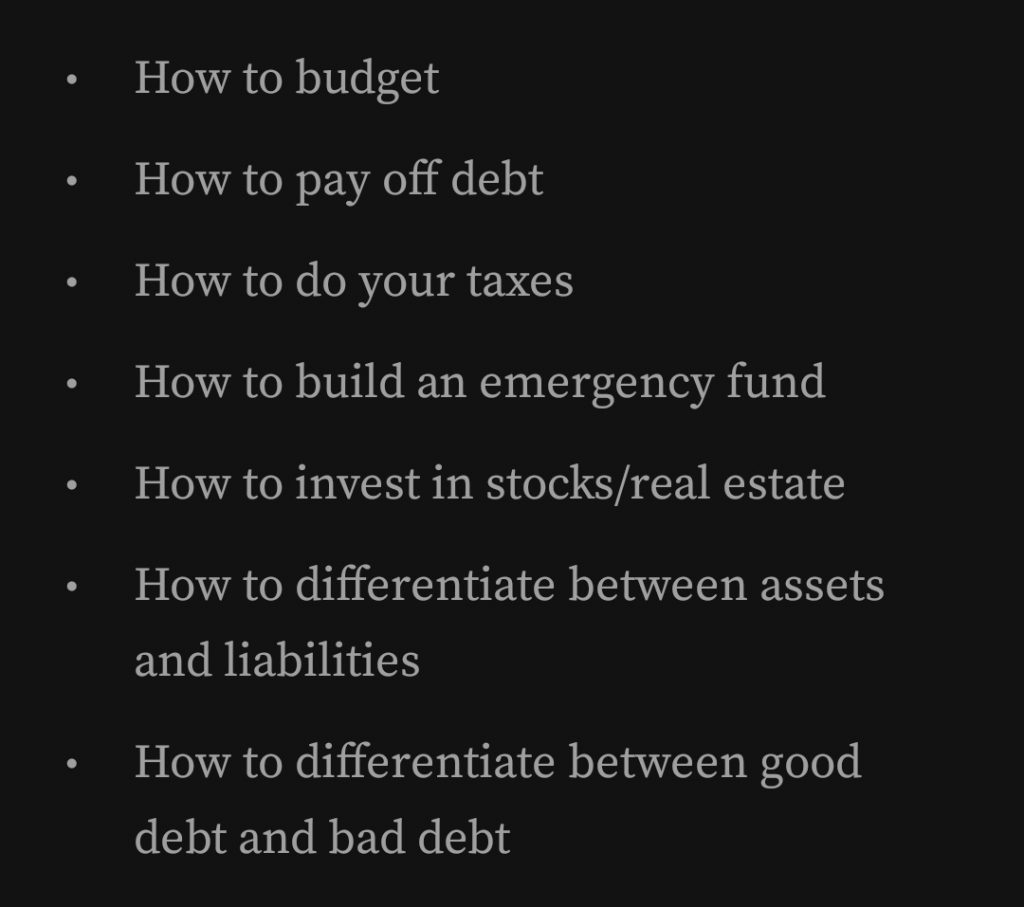

No matter which income level you’re at, you need to learn the foundations of financial literacy if you want to build wealth:

Remember, it’s not about how much money you make; it’s about how well you manage your money.