Money market is a section of the debt market which specialises in very short-term debt securities with maturities of less than one year.

The objective of a money market is to utilise every rupee for every day. Entities deploy surplus cash or borrow on overnight basis.

It matches the demand for and supply of short-term funds and borrowers and lenders tend to reverse roles often depending on their liquidity needs.

It is a complete need-based market rather than view based in nature and is liquidity driven, rates are determined by demand-supply of money.

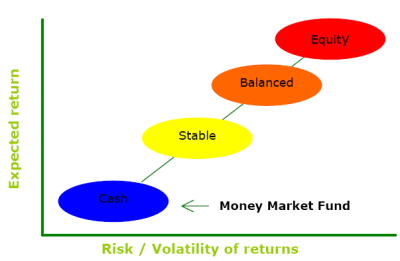

It is a wholesale market and the only way a retail investor can participate in this market is through liquid mutual funds.