Small investors have started feeling the pinch of declining cash flows due to Covid-related issues like salary cuts, job losses, furloughs and delay in credits of wages.

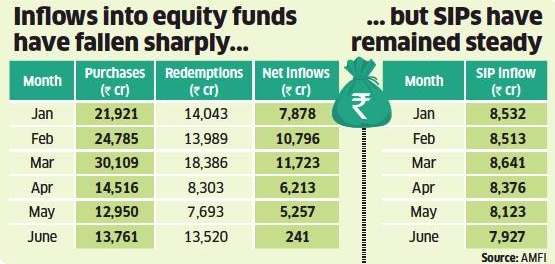

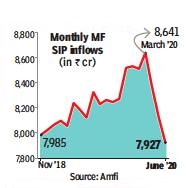

This is showing up in their shrinking contributions to SIPs in mutual fund schemes. Consider this: Since December 2018, investors were contributing Rs.8,000-crore plus every month. But in June this year, total monthly mutual fund SIP flows fell below that mark for the first time in 18 months to Rs.7,927 crore, according to data released by fund industry trade body Amfi.

In addition to declining cash flows, some fund houses had offered an ‘SIP pause’ facility to their investors — allowing them to stop SIPs for two-three months — which also contributed to the fall in total monthly values.

The fund industry’s June data also showed that the number of new SIPs registered had gone up. Combined with the fall in monthly SIP values, this indicates lower average contributions for new entrants. On an aggregate basis, the fund industry’s total assets under management crossed the Rs.25-lakh-crore mark again after remaining below that level since April, just when the Covid-19 pandemic started.

Reducing interest rates and a gradual unlocking of economic activity with an expected return to normalcy have led to renewed buoyancy in the markets. This, in turn, attracted investors to MF schemes.

Amfi data also showed that total monthly flows into equity funds slid sharply to Rs.241 crore in June, compared to Rs.5,257 crore in May — a drop of 95%. The main saviour was a Rs.587-crore net inflow into ELSS. The high inflows through this route were because of the government’s decision to allow investors to use tax-saving instruments under Section 80c of the I-T Act to save taxes till July 31, instead of March 31 for fiscal 2020.

On the debt side, investor interest is showing some uptick after Franklin Templeton MF’s decision in April to close six debt funds, which had deterred a large number of investors. Although liquid funds showed a sharp fall of Rs.44,226 crore in total assets managed by these schemes, industry players attributed this to mid-month withdrawals by corporates to meet their advance tax payment obligations. This is observed every quarter.

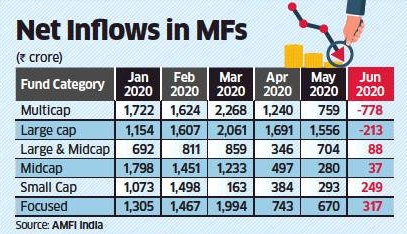

Net flows into equity mutual funds tumbled 95% in June from the previous month as the recent rebound in the market prompted investors to pull money out and stay on the sidelines. Equity schemes got ₹240 crore in June — their lowest monthly flows in four years — as against ₹5,246 crore in May.

However, average assets under management of equity funds rose to ₹6.89 lakh crore in June, compared to ₹6.31 lakh crore in the previous month thanks to the gains in the stock market and stability in flows through systematic investment plans.

Inflows into mutual fund schemes through SIPs in June fell to ₹7,927 crore from ₹8,123 crore in the previous month.

The Sensex and the Nifty have run-up close to 40% from the four-year lows on March 23 on account of easy monetary policy by central banks in developed economies.

Within equities, multi-cap funds and large-cap funds saw outflows of ₹778 crore and ₹213 crore, respectively. Tax-saving ELSS and focused funds saw inflows of ₹587 crore and ₹317 crore, respectively. Mid- and small-cap funds saw inflows of ₹290 crore.

Debt schemes saw net inflows of ₹2,862 crore with AUM of ₹12.36 lakh crore in June. In May, debt schemes saw net inflows of ₹63,665 crore with average assets of ₹11.53 lakh crore.

Liquid funds saw outflows of ₹44,223 crore as corporates withdrew for quarter-end considerations and payment of advance tax. Distributors said many investors had pulled money out of various debt scheme categories soon after Franklin Templeton shut down six schemes. Some of the debt scheme categories that invest in ‘AAA’ rated papers are seeing strong inflows, they said.

Corporate bond funds saw inflows of ₹10,737 crore; low-duration and short-duration funds saw inflows of ₹20,560 crore while banking and PSU debt funds saw inflows of ₹5,477 crore.

Some investors preferred to increase their allocation to the gold. ETFs mirroring gold prices saw inflows of ₹494 crore in June.