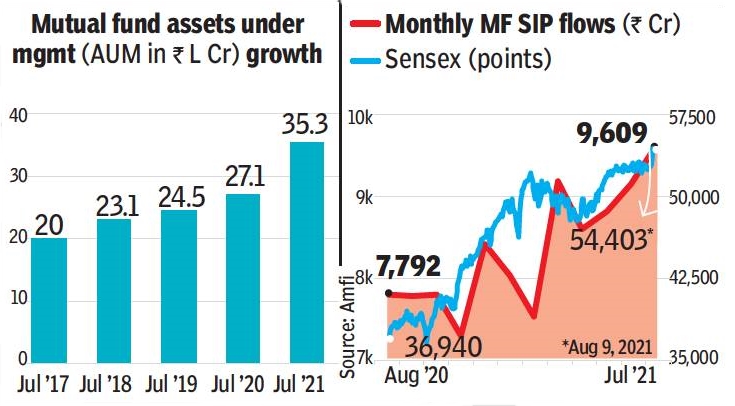

Strong flows into liquid, money market, new fund offers and sectoral funds helped total assets managed by the mutual fund industry to an all-time peak of Rs 35.3 lakh crore as of July end. With the stock market rallying to new highs at regular intervals, monthly SIP flows also recorded a new high of Rs 9,609 crore.

In addition, July set records for several other MF heads. These include retail SIP accounts at nearly 4.2 crore, total assets under SIPs at over Rs 5 lakh crore, retail assets under management at Rs 16.3 lakh crore, net retail flows at Rs 40,302 crore and net flows into equity funds at Rs 22,584 crore.

According to AMFI chief executive N S Venkatesh, the RBI’s accommodative stance, healthier earnings growth, vaccination-driven steady containment of the pandemic and global & domestic liquidity helped equity markets to historic highs.

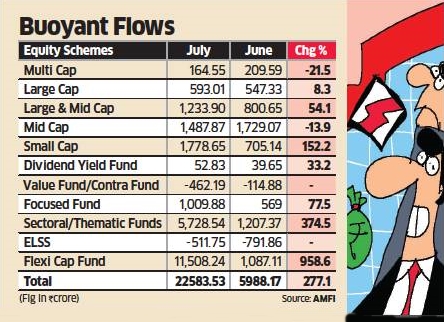

Data showed that during July, net inflow into all equity funds — at nearly Rs 22,600 crore — was its fifth consecutive month of positive inflow. The corresponding figure for the debt segment of the industry was almost Rs 73,700 crore. Hybrid schemes too witnessed net inflows of nearly Rs 19,500 crore, driven mainly by large flows into arbitrage funds.

NFOs too attracted strong interest among investors during the previous month. From 15 fund offerings that included four closed-ended ones, the industry mobilised a little over Rs 17,300 crore.