Most mutual fund investors make lower returns than their mutual fund schemes due to their bad habit of frequently getting in and out of schemes, shows an analysis of Axis Mutual Fund.

‘Analysis of Indian investor behaviour and its impact on performance’ by Axis Mutual Fund looked at the performances across different category of funds, including equity, hybrid and debt funds in the short and the long term.

The findings of the report conclude “investor flows are not stable but instead tend to follow market performance and as a result their realised returns are much worse than what they would have achieved by using either simple buy and hold or systematic investment strategies.”

The report further adds that the effect is persistent across different time periods and shows that there has been little change in investors’ behaviour over the last 15 years.

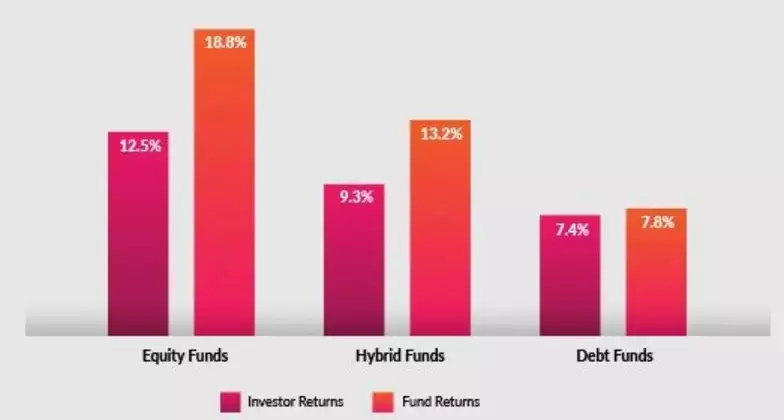

The report analysed investor behaviour for the period of 15 years between 2004 and 2019 for equity and hybrid funds. For debt funds, it analysed the behaviour over a period of last 10 years.

The chart below summarises the findings of the report over the long term for the periods mentioned above.

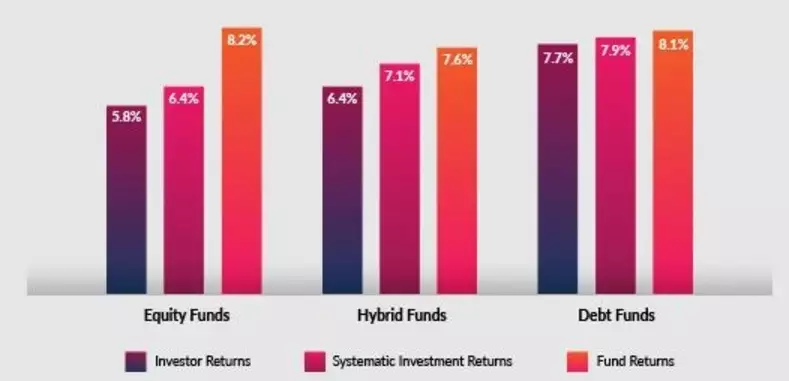

The report conducted the same study for a shorter time period of five years ending September 2019. The results were consistent that mutual funds made more returns than investors. Here, Axis Mutual Fund report also considered investments via SIPs or systematic investment plan apart from lumpsum investments. The chart below shows the findings.

“Overreacting to market sentiment, focusing largely on short-term performance and not investing early enough can make investors lose out on long-term gains and see lower returns,” says the report.

The report further states that investors can take three simple measures to avoid committing these mistakes. It asks investors to stay disciplined, start early and focus on long term fund performance instead of short term volatility.

“Invest regularly and on time, invest as early to aim for better returns and do not get swayed by the ongoing market fluctuations to aim for healthy investment and better returns,” says the report.