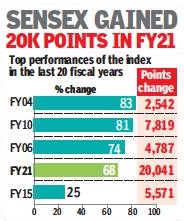

With a 627-point slide in the sensex on Wednesday, Dalal Street closed one of the most tumultuous years in its history. Within 12 months, the sensex recorded its sharpest slide on record and then, from near a multi-year low level, rallied to its all-time peak past the 52,500-point mark by mid-February. However, with several positive and negative factors impacting markets globally, the index closed the financial year 2020-21 at 49,509 points, up 68%.

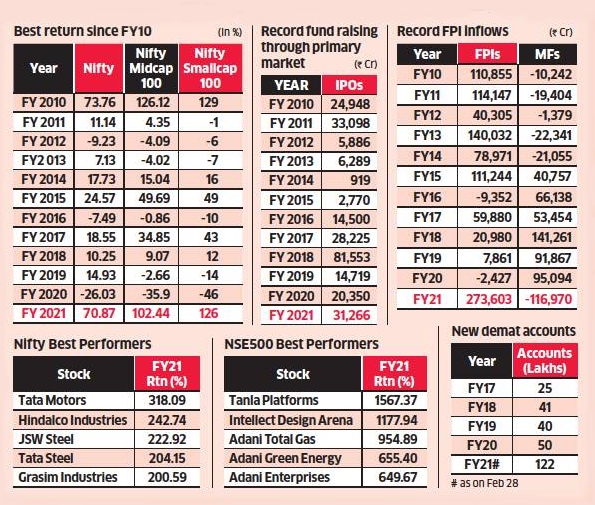

The rally in FY21 attracted foreign fund managers into the market like never before with the total net inflow for the financial year at almost Rs 2.75 lakh crore — also an all-time high figure, data from CDSL showed.

For market veterans, the sharp rally of FY21 was a deja vu moment. The uptick in FY21 came on the back of a sharp drawdown witnessed towards the close of FY20, which had recorded a negative return of about 30%. That was quite similar to the base that was created in FY09 when markets corrected by 40% due to the global financial crisis, which was swiftly followed by close to 80% returns for FY10.

With the Covid vaccines being rolled out at a fast pace across the globe and signs of economic revival emerging from various parts of the world, FY22 could also be a good year.

The year’s rally also made investors richer by a record Rs 94 lakh crore with BSE’s market capitalisation now at Rs 206 lakh crore. A major part of this gain came from the sharp rally in Reliance Industries, which saw its market capitalisation more than double from Rs 7.05 lakh crore to over Rs 15 lakh crore, but closed the year at Rs 13.2 lakh crore.

During FY21, the sensex gained 68%—the highest in over 10 years and the fourth highest in the last 20 years.

The year also saw a record amount of funds being raised through the IPO route at Rs 1.9 lakh crore and Rs 64,256 crore through the rights offer route. RIL, which successfully closed its Rs 53,124-crore rights offer during the year, was the biggest equity issue in the country’s history.

The Nifty returned almost 71% in the financial year ended March 31 — the best since FY10 — in a record-breaking rally, though it raised questions whether the market has run up too fast? Foreigners propelled the upmove, pumping ₹2,73,603 crore during the financial year—the highest ever inflows —aided by dollar’s weakness on account of the gigantic stimuli by the US government and the Federal Reserve. Domestic retail investors were not left behind. They pulled money out of mutual funds and took control of their own investments. Valuations are rich at current levels but investors are pinning hopes on a sharp rebound in FY22 earnings to help markets justify these levels.