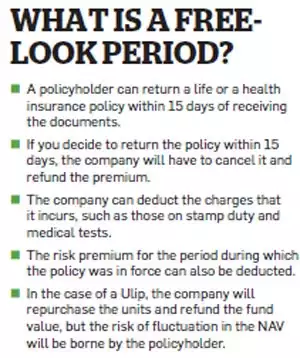

The law allows 15 days as free look period from the date of receipt of the policy document to the policyholder. The policyholder is allowed to cancel the policy during this period and get a refund.

Types of policies

Free-look period is available only for life insurance policies. For health insurance policies, the term should be at least three years.

Cancellation request

Once the policy holder is convinced that the policy terms do not match his or her expections, they should communicate their intention to cancel the policy in writing. Some insurance companies prescribe a standard form for cancellation of policy during the free look period. Policy details, date of receipt of policy document, reason for cancellation and agent details must be mentioned in the application.

The process

On receiving the cancellation request, the insurance company will get in touch with the policyholder to know the reasons for cancellation and try to provide solutions. However, if one still wishes to cancel the policy, the insurance company will have to process the request and issue refund.

What is refunded?

Once the refund application process is completed and approved, the refund premium is calculated after deducting the following:

• Pro-rated risk premium for the period on cover

• Medical examination expenses incurred by the insurance company

• Stamp duty charges

Ulip refunds

In case of refund of a Ulip policy, since the policy is market-linked, the refund premium will be as per the prevailing NAV of the Ulip applicable on the date of policy cancellation (after deducting the above charges).

Point to note

• It is the responsibility of the policyholder to prove the date of receipt of policy document.

• In case of online sale of policy, the free-look period of 15 days is extended to 30 days.