The shake-up happened late last year when the regulator revised norms for asset allocation in multi-cap funds. Sebi’s gripe was the heavy large-cap bias in multi-cap funds construed as not being ‘true to label’. It ruled that funds in this category would no longer be allowed any flexibility in choosing allocation to different market cap segments. To better fit the nomenclature, these were instead required to compulsorily park atleast 25% in each of the three market cap segments—large-cap, mid-cap and small-cap. But this was seen as a restrictive mandate by asset managers. They argued that the funds’ risk profile would change drastically under new rules. Sebi indulged by introducing a separate category—flexi-cap funds. These funds have since taken the mantle of erstwhile multi-cap funds. They can invest with the same flexibility as before. Not surprisingly, bulk of the multi-cap funds shifted to the new category to retain freedom to invest anywhere. The handful of AMCs that chose to persist with the multicap mandate wasted no time launching flexi-cap flavours.

As expected, most flexi-cap funds have retained their large-cap tilt. The average portfolio market cap of flexi-cap funds is around ₹1.3 lakh crore. Meanwhile, due to their restrictions, multi-cap funds operate lower down the market cap ladder. These run an average portfolio market cap of ₹48,000 crore. However, the disparity in positioning is higher among flexi-cap funds. This basket comprises a fund running with a portfolio market cap as low as ₹50,000 crore and another fund operating at ₹3.24 lakh crore. Comparatively, multi-cap funds operate within a tighter market cap band of ₹35,000 crore to ₹65,000 crore. Clearly, the two categories have assumed distinct identities.

Despite the visible difference in positioning, it presents a dilemma for investors. Both fund types essentially straddle multiple market cap segments, albeit to different degrees. Multi-cap funds are still allowed to invest the last 25% anywhere as per the whims of the fund manager. This 25% can swing the entire fund’s risk profile. Put the recently anointed large-and-mid-cap funds into this mix and investors’ selection problems compound further. These funds are required to invest at least 35% each in large-caps and mid-caps. So how do you pick from categories so closely tied together?

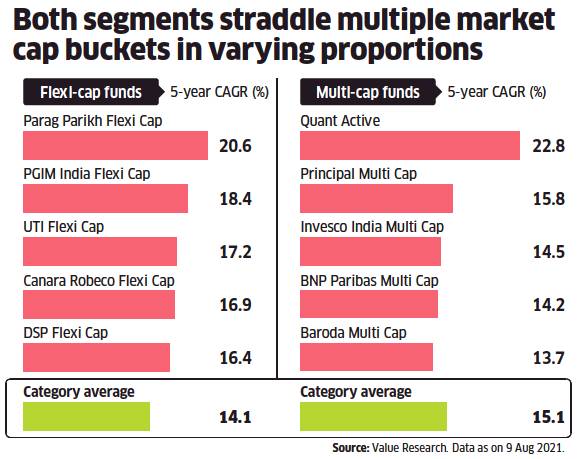

The risk profile of the two are quite different owing to the gap in broader market exposure. A comparison of returns is not yet possible as multi-cap funds have not even completed a year under revised norms. But given that multi-cap funds have to invest at least 50% in mid- and small-caps, these are likely to be exposed to higher volatility inherent to this space. These may fetch outsized returns compared to their counterparts when the broader market is in favour. This is what played out over the past six months. But when the tide turns, multi-cap funds will likely underperform. Flexi-cap funds on the other hand can be expected to provide better downside protection, owing to the large-cap bias. They will typically lag behind during a broader market uptick.

Flexi-cap funds should be first preference for investors, according to financial planners. There is no compelling reason for investors to explore the newer multi-cap or even large-and-mid-cap strategies.

Experts contend that the choice of fund should be guided by the investor’s existing asset mix and the desired allocation.