Extracted from an article by Bridget Casey

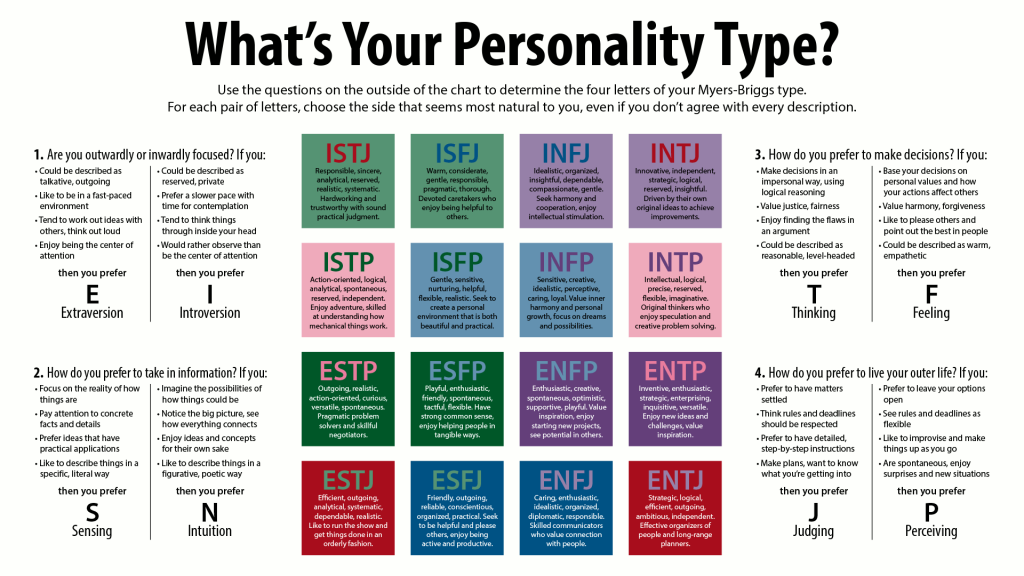

Not sure what your Myers-Briggs Personality Type is? You can take the test here!

Don’t forget, your personality may change slightly over time, too.

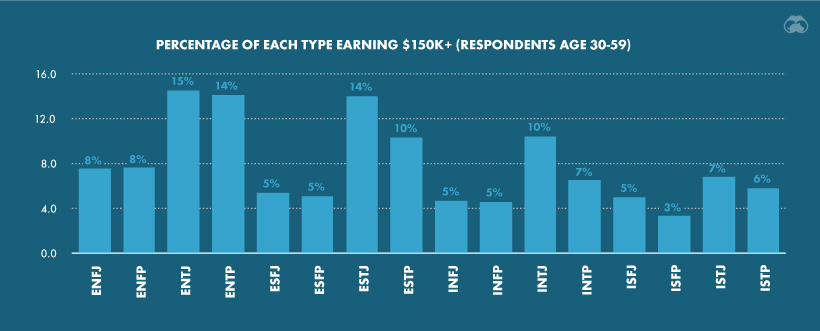

Extroverts tend to out-earn introverts, likely because they take to managing people. Sensors earn more than Intuitives, and Thinkers earn more than Feelers. Finally, Judgers earn more than Perceivers. From this, you can guess right away that ESTJs are likely to be the biggest earners, and INFPs probably bring home the least.

Research indicates that ESTJ and ENTJ typically bring home the highest incomes, with an average of about $75,000 per year. ISFP and ISTP are the lowest earners, with an average of only $30,000 per year. Apparently earning more as a Sensor is only true if you’re also an extrovert!

While it’s fun to look at this data, it’s important to remember your MBTI is not necessarily a predictor of your income. There are multi-millionaires and those living below the poverty line of every personality. Don’t feel discouraged if your MBTI doesn’t typically rank high in bringing home the bacon.

What your Myers-Briggs Personality says about how you manage money

Below is a short description of how each of the 16 Myers-Briggs personality types manages money. The following is completely made up and not based in science of any kind, and should not be interpreted as financial advice. It may not even be remotely accurate! These assumptions were crafted based on the definitions of the Myers-Briggs Personality types on 16Personalities.

ENFJ – The Protagonist

The ENFJ is a sociable do-gooder, so you’re most likely to find them throwing a lavish birthday party for their best friend. These charming extroverts make good team players and work hard to see everyone succeed. They’re not particularly good at saving, but they don’t care much for showing off either so it’s relatively easy for them to amass a decent nest egg. Ever optimistic, they’ll trust a financial advisor to put their money wherever it can do the okayest job, and call it a day. ENFJs have one major financial achilles heel, however: they struggle to make tough decisions, so they’ll agonize about any major purchase, like getting a graduate degree or buying a home. Their anxiety is often the biggest cost!

INFJ – The Advocate

The INFJ cares for causes and is more likely to be protesting rising tuition costs or big bank bailouts than paying off their own debts. This type is likely to choose a career in public service or where they can directly support an underprivileged or marginalized group, so their compensation is usually small. They’re good savers, but they’ll loan cash to a friend in need and make room for charitable giving in their budget, even when they can’t really afford it. Their stock portfolio consists entirely of ethical investment funds, and they sleep easily on lower returns because it bought them a clear conscience. Expect them to be setting aside money to prepare for the climate crisis.

ENFP – The Campaigner

If you have a friend who spends money like water, they’re probably an ENFP. These cheery spendthrifts have never heard the word “frugal” and would ignore it if they did. ENFPs earn money purely so they can spend it, and since they love spending it, they are motivated to earn a lot. It’s difficult to get them to do anything responsible with their money since money in a savings account doesn’t buy anything fun, so the best approach is maybe to convince them what luxuries their savings and investments will buy later. ENFPs will be perpetually battling credit card debt and will likely neglect their student loans entirely. It’s likely they won’t fix their finances until they’re at their credit limits and don’t have any choice!

INFP – The Mediator

The INFP is your friend who keeps joining one MLM after another. Last week they were going to retire in 2-5 years with Amway, this week they’ve invited you to join their friends Gifting Circle. These friendly and idealistic individuals like money, but they always expect it to come easier than it really does. They only like it when it’s interesting, too, so anything about past performance or historical returns will make their eyes glaze over. INFPs don’t think about retirement, so they don’t save for it, but they will buy absolutely anything in a “last chance sale!” email or while waiting in the grocery store checkout. The best way for INFPs to save and invest is with an “out of sight, out of mind” tactic. If their savings aren’t completely removed from their everyday banking, they’re going to spend it.

INTJ – The Mastermind

The INTJ is goal-focused in everything, including their finances. They take a steady plod to the top of their career, as well as disciplined in regularly setting aside savings. They’ll predict the future value of their stock portfolio six decades from now down to the penny. They aren’t showy or extravagant, so their money almost always goes where it can get the best ROI. They tend to buck tradition and rules, so are most likely to amass a modest sum and FIRE in their late-30’s or 40’s. INTJs are also arrogant and judgemental, so they’ll vocally criticize anyone who doesn’t follow the same financial path.

ENTJ – The Commander

The ENTJ has an absurd tolerance for risk and will aggressively invest in trendy stocks or fledgling start-ups in an effort to 25x their initial investment. If they lose money, they don’t even stop to grieve because they’re already on to the next venture. ENTJs exude genuine confidence and are not afraid to negotiate so they receive raises and promotions at a faster clip than any other type. Making money is more important than spending it, so they’ll amass a small fortune while pursuing their career success. ENTJs will likely accumulate debt to reach their goals, but wipe it out as soon as the next big payout comes in. They’re comfortable with risk, and won’t bat an eye at a six-figure loan balance if it helps them get to the top.

INTP – The Architect

The INTP has good intentions but often spends more time strategizing than actually doing. Expect them to craft elaborate spreadsheets comparing ETFs in an attempt to reduce risk and taxes, only to find the allocations have changed by the time they’re finally ready to invest. If they can get themselves on to an investment plan, they’ll stick to it and end up with a comfortable retirement, but if they think about it too long they’ll put themselves at risk. Wary of debt, they’ll avoid it unless it’s absolutely necessary to bring about the desired income (and only after they’ve done an in-depth ROI analysis of how they’ll use the funds AND pay it off). The only thing the INTP really can’t handle is criticism, so no matter what they’re doing with their money, don’t tell them it’s wrong.

ENTP – The Inventor

The ENTP earns a good income but has a tendency to spend money as quickly as it comes in. They are easily swayed by anything shiny and new, but that includes the best performers on the stock market. If they’re in the corporate world, the ENTP is probably eyeing the exit, looking for an opportunity to start their own business. When it comes to money, they’ll find new and innovative ways to make tedious tasks painless, and let the rest take care of itself. Expect them to have automated virtually every financial responsibility so they don’t have to think about it. However, despite their penchant for streamlining processes, they’re careless with details. An ENTP is equally likely to misplace $5,000 in a savings account (or a crypto bank) as they are to casually leave out a $5,000 debt from their net worth spreadsheet. They only understand money in the context of using it to do other things, so it will be “easy come, easy go” the whole way through.

ESFP – The Entertainer

ESFPs generally hit a good balance between spending and saving, with a few dips into credit for the latest eyeshadow palette at Sephora. ESFPs like to look good and will spend money doing so, but the core of them is practical so they’re diligent about setting dollars aside in savings. They have credit cards, but rarely let their spending get out of control, and their student loans were paid off in a timely manner without to much hassle. These extroverts love to work the room, so they do good in sales or anything commission based, which gives them a fairly decent income. Their only real financial flaw is ESFPs are poor long-term planners. So while they don’t have trouble saving and investing, they’ll need guidance on how much to put away and exactly how to do so.

ISFP – The Adventurer

ISFPs like money they can feel, right on their skin, like absurdly high-thread-count Egyptian cotton sheets. Expect these high-rollers to drop dough on the best of everything: best clothes, best experiences, best stuff. However, to their credit, they always live within their means. ISFPs are careful with their money, but when they have dollars to spend, it’s going to unique pieces of art, helicopter tours, or a reservation at the finest restaurant. They don’t get in your face about flexing, but a competitive side of the ISFP does make some of their buying decisions out of the desire to be “better” than their peers. Expect an ISFP to make quiet but profitable investments in luxury real estate, wineries, or original paintings. As much of their net worth is going to be tied up in heirlooms as it is their bank account.

ESFJ – The Provider

The ESFJ likes to spend, especially if it’s on someone else. Expect these folks to flex with big houses, luxury cars, and a designer wardrobe, for them and their children. They’re invited to every party where they always show up with fine wine or a lavish hostess gift. Under the hood, they’re probably carrying a fair amount of credit card debt, a hefty student loan for financing a degree at an Ivy league instead of going to a state school, and you can be sure their car is financed. Nevertheless, they’ll never miss a minimum payment because they’d find it too embarrassing to be perceived as poor. At work, they make good leaders that are promoted for their ability to continuously rally the troops and make every team member feel valued. This often translates into managerial roles with good pay, so they can keep their lives afloat.

ISFJ – The Defender

The ISFJ might be the most responsible money managers of all, crafting budgets for small and major purchases alike, and not pulling out the plastic until the full total is saved. These practical workers set attainable financial goals and meet them without fanfare. They are patient, so they don’t worry if something seems a long way off, they simply keep going. They never get burdened down by debt fatigue, or enticed to buy something they can’t afford. ISFJs choose careers that help others, so their paycheques might not be large but their lives are full.

ISTP – The Operator

Expect to find the ISTP chanting, “experiences not stuff!” as they drop five-figures on an African safari. ISTPs might be even bigger spendthrifts than ENFPs, except they tend to be more purposeful about it. ISTPs want a rich life, and they make their purchases accordingly. The downside is they’ll do most of it on credit. They’re even more risk-loving than ENTJs, and might even get caught up doing more gambling than strategic investments. The only way to ensure financial security for an ISTP is to catch them before they do irreparable damage to their credit score.

ESTP – The Entrepreneur

ESTPs are indulgent, so expect to find them spending their money mostly on whatever makes their body feel good — from food to massages — with everything else taking a back seat. These people are bold and sociable, so don’t be surprised if they charm their way into owning the restaurants or spas they love to frequent. Thankfully, their investments usually pan out well, so they earn the income they need to keep up with treating themselves. The biggest financial dangers to an ESTP are over-extending their credit to take on a new venture, or butting heads with a business partner. When they’re wrong, the financial losses are big, but they’re usually able to recover.

ISTJ – The Logistician

The ISTJ is one of the most practical and dutiful personalities, and that’s reflected in their finances. Their bills are always paid on time, they don’t owe anything when they file their taxes, and they’ve been investing since they were old enough to open an account. They have both a financial advisor and an accountant, but they don’t actually need either of them and mostly hire to have someone admire their work. If you can think of sound, solid financial advice, the ISTJ has been following it since they first read The Wealthy Barber in junior high school. They pay off student loans ahead of schedule, buy homes early, and take care of their families with steady paycheques. If they ever make a financial mistake, they beat themselves up for it relentlessly, often long after they’ve remedied the error.

ESTJ – The Executive

The ESTJ likes to be wealthy and wants you to know it. The highest earners of all the MBTI personality types, these workers bring in money simply to watch the balance grow in their bank account. They take calculated risks with healthy investments that over time, enjoy generous compounding returns. They use debt only if it will make them money, and would never whip out a credit card for an unnecessary purchase. The ESTJ wants to be seen in the best circles, so they focus on getting their bank account to whatever number will buy them admission to the highest social class. When you consider their net worth, the ESTJ is downright frugal, but they’ll splurge on club memberships and anything else that will get them “seen” where they belong.

Final thoughts on Myers-Briggs and Money

How much your MBTI personality has to do with your income potential, savings habit, and ability to tackle debt is interesting and fun, but not determinant. Anyone can get a handle on their money and make good financial choices. However, knowing your strengths and weaknesses might help you leverage them to better optimize your money!