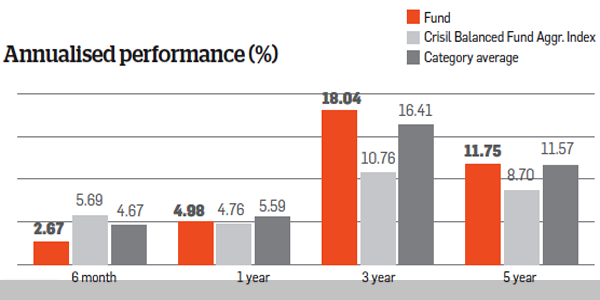

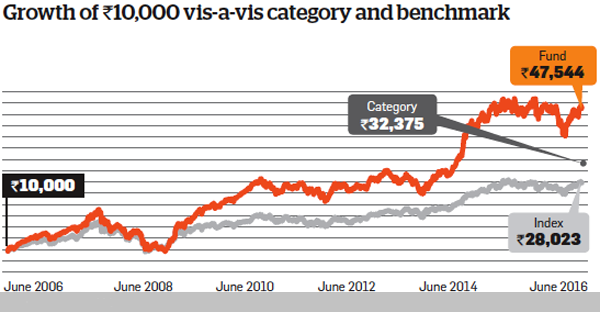

An equity mutual fund scheme generates return based on the movement of stock prices in its portfolio. So when you evaluate returns from the scheme invested in, compare it with its benchmark. For example, if the fund you own is benchmarked to the Nifty , and has given a return of 26% over the last one year, vis a vis the Niftys 23%, it has outperformed its benchmark. However, if it gives 20% return it has underperformed it. Many online websites enable you to compare these returns with their benchmark at the click of a button. Investors shouldn’t compare equity returns with other asset class such as gold, FD or real estate.

If the fund has beaten its benchmark, the next important step is to see if it is ahead of similar funds in its category . For this one has to make sure that one compares similar funds –namely a large cap fund with another large cap fund only and not with a mid or a small cap fund. Each category of fund has a different driver of performance. Each set behaves differently across market cycles. A good fund should outperform or do better than its benchmark and category . If there are 10 funds in the category and the fund consistently is amongst the bottom three, and not able to beat category average, it indicates that there are better funds out there.

Consistency in performance is an important parameter to look at before choosing a fund. If fund performance is unstable, that is it outperforms in bull markets and underperforms in bear markets, it is better to avoid it in your portfolio. A fund should beat its benchmark and category average at all times. The above is a starting point to judge your fund performance. In addition to this, investors would also need to look at other ratios and qualitative aspects like the fund house strategy and the fund management team while taking a decision.