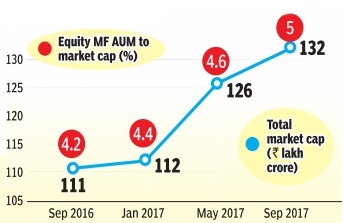

With retail investors participating in the stock market rally in zest, equity mutual fund assets under management as a percentage of India’s stock market capitalisation (market cap or m-cap) has touched an all-time high of 5% in September. It has increased 0.8% over the last one year.

The assets managed by equity funds (including equity-linked savings schemes or ELSS) surged 40.8% year-on-year or about Rs.1.91 lakh crore to around Rs.6.59 lakh crore at the end of September this year. The proportion of equity MF assets to m-cap has increased despite a sharp jump in the markets. The market cap of all companies listed on the BSE grew 18.9% y-o-y or Rs.21 lakh crore to Rs.132 lakh crore in September. The total market cap now stands at Rs.139 lakh crore. The equity MF AUM-to-market cap ratio was hovering around the 4% mark for about 18 months starting September 2015. It moved past 4.5% only in April this year and has seen a steady increase ever since.

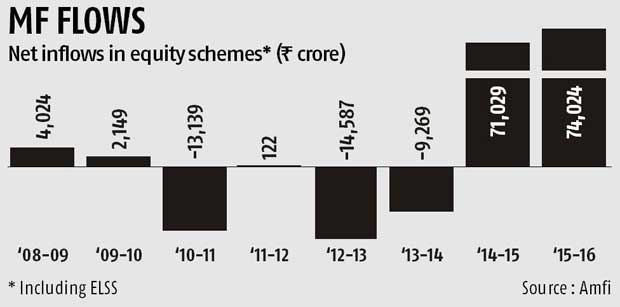

With investors pumping record amounts of money into equity MF schemes, fund managers have been able to massively increase their deployments in the stock markets. Total net inflows into equity funds (including ELSS) stood at a record Rs.80357 crore (about $12.4 billion) for April-September, a 3.6 times jump compared to the previous year.

Equity MFs have invested nearly $12 billion (about Rs.77000 crore) on a net basis in shares between April and September, the highest ever for a six-month time frame. Fund houses have invested more than 2.5 times the money foreign institutional investors have deployed in the current year.