Indian crypto investors resorted to panic selling after the government listed a bill seeking to ban private cryptocurrencies, while allowing an official digital currency by the RBI. Cryptocurrency prices in the Indian — linked to rupee — market crashed by up to 20% before recovering after exchanges allayed investors’ fears.

The price of bitcoin, the largest cryptocurrency, was down 10% against the rupee at Rs 40 lakh on Wednesday evening (the crypto market is open 24/7).

Cryptocurrency exchange founders assured nervous investors that their digital assets are secure even as they welcomed the proposed bill to regulate virtual currencies. They said the government’s announcement is a positive step since a well-defined framework will not just help in structured adoption but will also put a tight check on unregulated crypto markets, a concern for the regulators.

“First, we need to understand that there is a lot of speculation around the term ‘private cryptocurrencies’, which will be put to rest once the fine print of the bill is out,” said Gaurav Dahake, CEO & founder of cryptocurrency platform Bitbns.

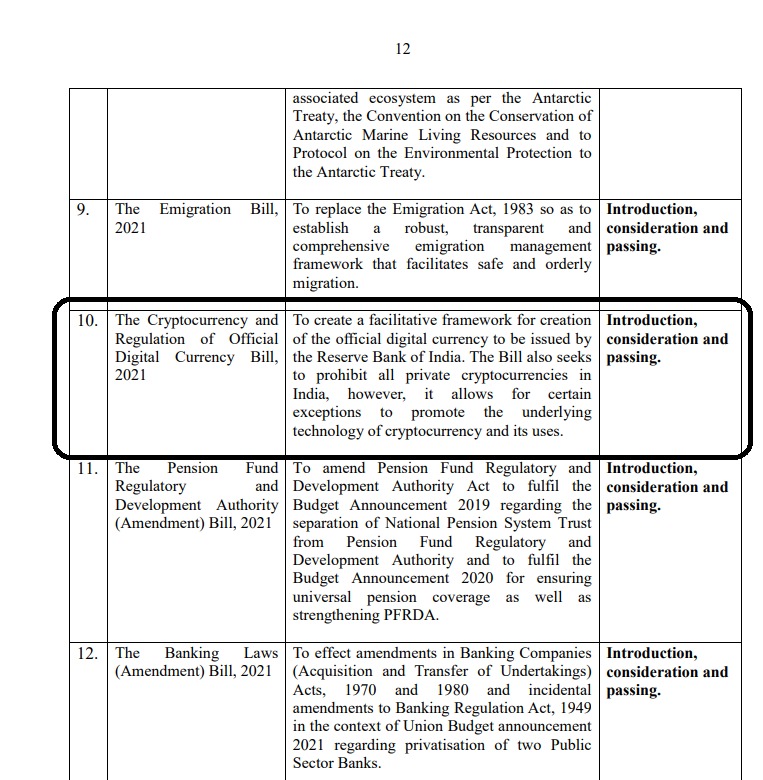

The bill, which reportedly seeks to safeguard small investors by treating cryptocurrency as a financial asset, has major ramifications for the industry that has remained unregulated so far. It is set to be introduced by the government in the upcoming winter session of Parliament. A description of the bill showed that it aims to prohibit all private cryptocurrencies except “certain exceptions to promote the underlying technology of cryptocurrency and uses”.

On Wednesday, a Bloomberg report said the government may not have a complete ban. The legislation may stipulate a minimum amount for investments in digital currencies, while banning their use as legal tender, the report said.

Earlier this year, RBI governor Shaktikanta Das had said the central bank may pilot a digital currency by December. While there is widespread fear about a blanket ban, founders at crypto exchanges remained positive about the outcome.

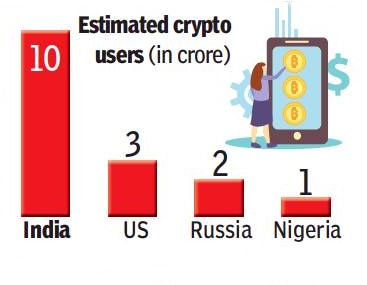

Industry experts said cryptocurrencies have already been regulated across leading economies such as the US, the UK, Singapore and Japan. With India now hosting the largest number of cryptocurrency investors in the world, it is just a matter of time for the government to adopt smart regulations for the sector.

Regulation may also lead to earnings from crypto attracting both direct and indirect taxes.