Investors with a high risk appetite can earn as much as over 14% by putting money in credit risk schemes of mutual funds after bond yields in October spiked due to the IL&FS issue. Credit risk schemes invest at least 65% of their corpus in debt securities with ratings of AA and below.

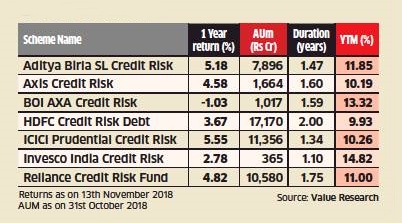

Invesco India Credit Risk Fund is currently yielding 14.83%, Aditya Birla SL Credit Risk Fund is returning 11.85%, BOI Axa Credit Risk Fund is at 13.32% and Reliance Credit Risk is at 11%. The final returns need to be calculated after deducting the total expense ratio for the fund. Direct plans could have an expense ratio of 50-100 basis points, while regular plans have an expense ratio of 1.25-2%.

Some experts believe high risk investors can allocate 5-10% of their portfolio to take advantage of the high returns.

Distributors point out that retail investors have been nervous about investing in the debt mutual fund space post the IL&FS fiasco. Four fund houses have written off either partially or fully their investments in IL&FS as the company failed to pay off investors for papers that came up for maturity. This has led to losses for investors in their debt funds and there is a flight to safety amongst such investors.

Financial planners say the product is for those with high-risk appetite. This is because if a fund manager holds a bond with a lower rating in the portfolio and it defaults or faces a further downgrade, it may be difficult for the fund manager to exit this holding. They suggest investors look at a fund with a lower expense ratio and make sure the portfolio does not have high exposure to any debt security or sector.

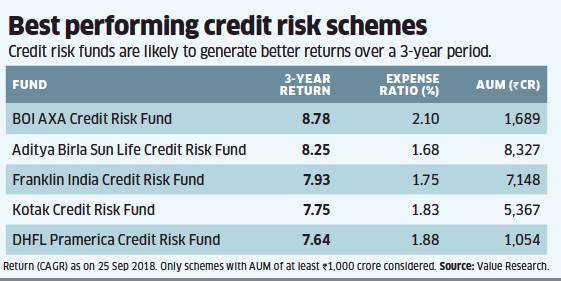

Taking a look at the past performance…..

What are credit-risk funds?

Credit-risk funds are debt funds which have at least 65% of their investments in less than AA-rated paper. They generate high returns by taking higher credit risk and by investing in lower-rated papers. Such companies offer higher interest rates and as and when their ratings move up, they offer a benefit of capital gains. The interest risk in these funds is low as most of them have a lower duration. These funds typically have the potential to give 2-3% higher returns compared to risk-free papers.

How do these funds work?

Credit-risk funds make returns in two ways: one, they earn interest income on the securities they hold. Secondly, since they invest in lower-rated securities, if the rating of a security is upgraded, they have the potential to make capital gains.

What is the tax treatment of these funds?

Dividends are exempt from tax, but the scheme has to pay a dividend-distribution tax of 28.84%. Returns you earn within three years of investment are subject to short-term capital gains tax. This will be as per your income-tax slab. After three years, you are eligible for long-term capital gains tax at 20% with the benefit of indexation.

How should investors choose a credit-risk fund?

Credit-risk funds have a higher liquidity risk. If a bond with a lower rating in the portfolio defaults or faces a further downgrade, it may be difficult for the fund manager to exit this holding. Financial planners advise investors to choose large-sized funds in this category. Higher assets give the fund manager better scope to diversify and spread risks. Investors should also look at a fund with a lower expense ratio and make sure the portfolio is not concentrated or has high holdings in any single business group. They should choose a fund manager and a fund house with good experience in managing debt portfolios. Finally, investors should not hold more than 20% of their debt portfolios in such funds, which typically carry higher risk compared to other debt funds.

Things to consider while investing in Credit Risk Funds:

This fund comes with the inherent credit risk of a rating downgrade. In case of rating downgrade fund may not generate expected returns.

If you are not a market-savvy person, you should stay away from these types of funds.

You should select a fund with a reputed and experienced fund manager.

Investors should also look at a fund with a lower expense ratio.

Make sure to select large-sized funds. It is because higher the corpus better scope of manageability.

The portfolio should be well distributed and not concentrated. It reduces the risk of credit incident.

These types of funds are more suitable for high-risk high returns investors.