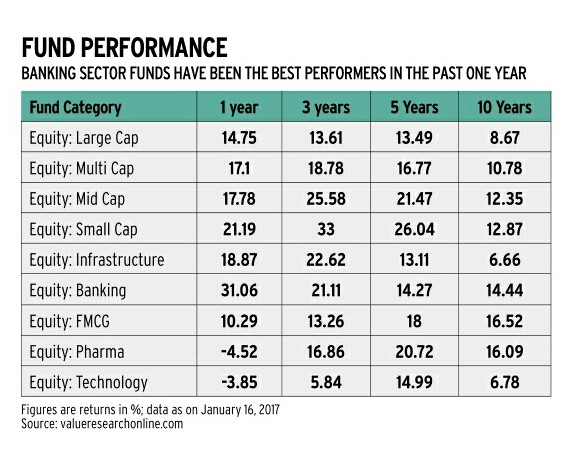

The past 1-year returns for funds in the large-cap equity category ranged from 12% to 36%. In case of market-linked investments, rankings based only on returns can change at short intervals, and moving in and out of funds based only on performance can be costly and counterproductive.

If not returns, then how does one choose?

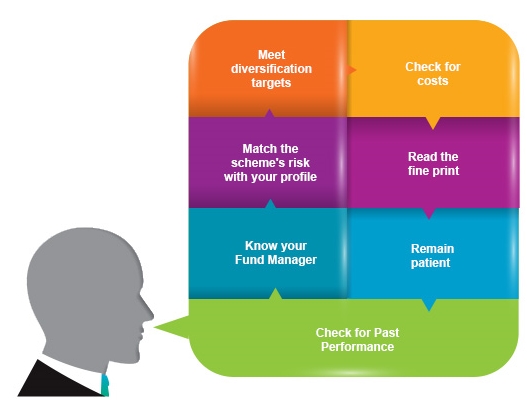

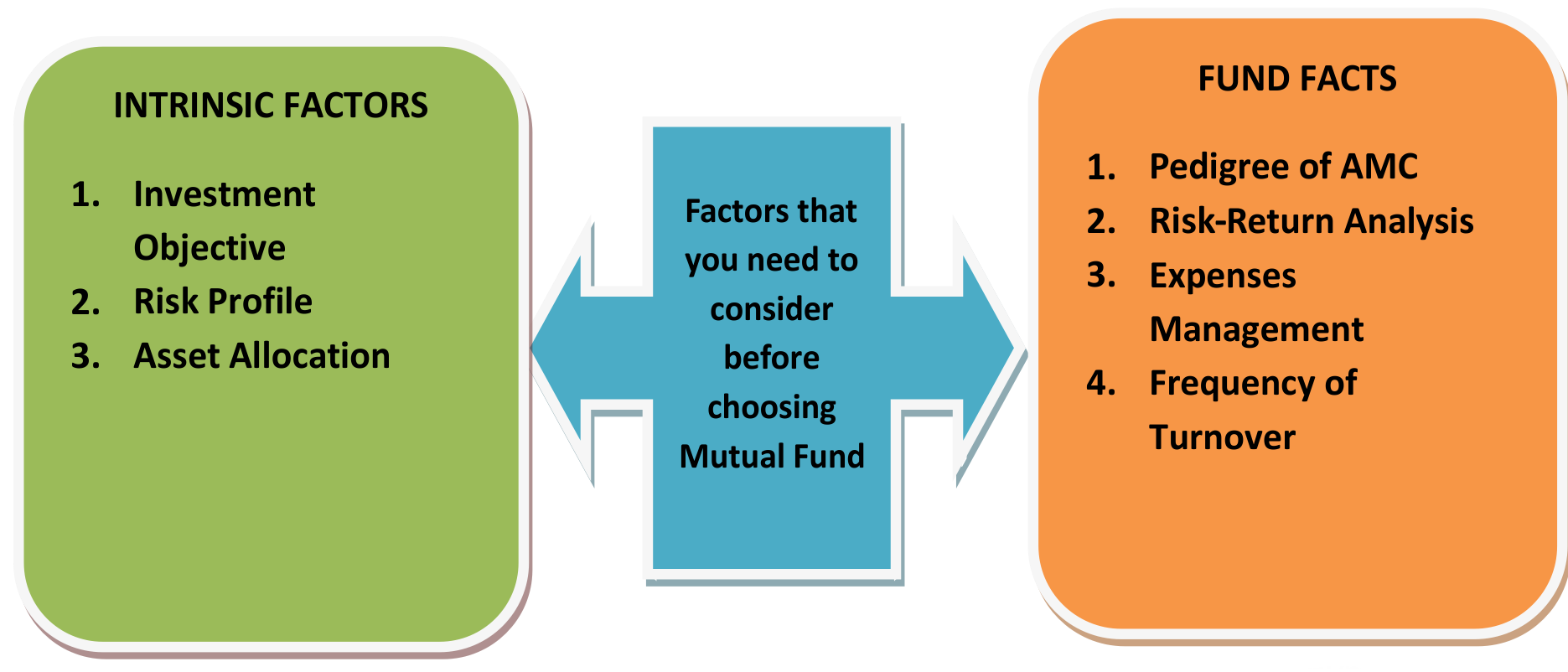

In addition to past performance, looking at the consistency of performance and risk measures like fund beta and Sharpe ratio can give an indication of what to expect. A fund that hasn’t displayed consistent performance in the past is considered high risk. A fund portfolio with a beta greater than 1 indicates sharper movement relative to the market. Secondly, while performance and risk numbers will change depending on when you are looking, the fund manager’s ability and focus around the fund ideally shouldn’t waver.

A fund manager’s stock selection style, the investment process and ability to move from one company to another will eventually result in the returns that a scheme earns.

These are subjective factors and an average investor may not be able to evaluate them easily.

For investors, the focus in equity mutual funds should be to build a diversified portfolio, which can be held for at least 7-10 years.

Market dynamics change but fund managers often select stocks based on their earnings conviction for a particular company, which takes time to play out.

An adviser can help you pick funds for the long term and hand hold you through short-term lapses in performance. Performance tracking is something that should be left to the adviser.

Fund selection can’t be based solely on performance. A fund at the bottom today can well be a top performer 6-12 months later.

While some objective criteria should be looked at for fund selection, as it establishes a performance track record, a lot of the selection is subjective.