It may be an early trend, but it points to changing investment behaviour in the country.

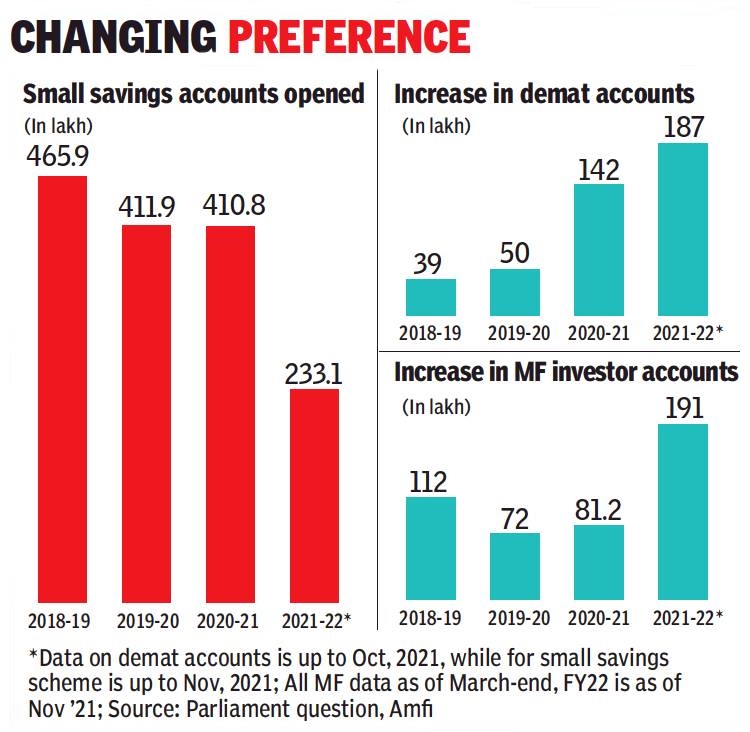

The government presented two sets of numbers in Parliament, which showed that the growth of small savings accounts had slowed down over the last three years. This included almost every scheme, barring Sukanya Samriddhi for the girl child.

In contrast, there has been a spurt in the number of demat accounts opened during this period, indicating that more investors were opting to park their funds in equities by investing directly in the stock markets.

So much so that between April and November 2021, 2.3 crore new small savings accounts were added, translating into a monthly average of around 29 lakh.

During April-October 2021, a little less than 1.9 crore demat accounts were opened, translating into an average of 26.7 lakh every month. The number of accounts opened during seven months for the current financial year is over 30% higher than the number for the previous full financial year.

If one were to look at the total stock of demat accounts, their number has jumped over two times from under 3.6 crore in 2018-19 to 7.4 crore at the end of November 2021.

Most investment advisers would tell you about the swelling number of retail investors seeking to take advantage of the stock market rally, which has resulted in more and more flocking to invest in equities, either directly or through mutual fund route.

No wonder that compared to March-end, the number of mutual fund folios had shot up by 1.9 crore when AMFI released the data last week. And, again, the number of folios added during this period is twice the number increased during the last financial year.