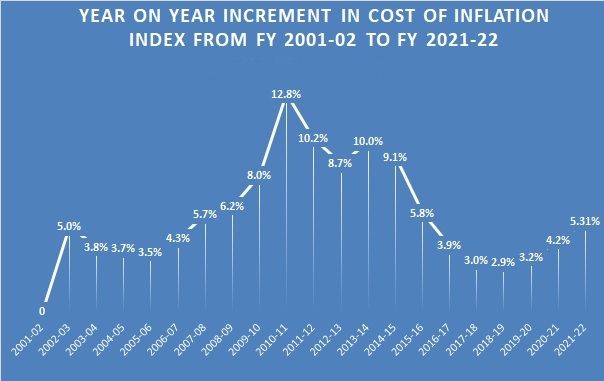

As inflation increases, the prices of goods increase too. Due to this, the purchasing power of money falls. For instance, if you can purchase ten units of some products in Rs. 1,000 today, you might only be able to buy eight units after two years due to the rise in inflation.

But how is this increase in the price of goods due to inflation measured? With the help of the Cost Inflation Index.

With regards to taxation, CII could help investors reduce their capital gains from the sale of long-term capital assets. As the capital gains fall, so does the applicable income tax on the gains.

- WHAT IS CII?

As mentioned above, CII calculates the increase in the price of goods due to inflation year-by-year. For instance, let us assume that you purchase 10gms of gold today at Rs. 42,000. You sell the same after two years at Rs. 50,000. So, the capital gains here would be Rs. 8,000. You will then be required to pay applicable taxes on this amount.

But assets like gold, real estate, debentures, and even debt funds get more expensive with time as the inflation rises. So, with regards to the same example, CII would allow you to increase the purchase price of gold (previously Rs. 42,000) to make up for the price rise due to inflation.

This will help in reducing your capital gains when you sell it at Rs. 50,000. As the capital gains would fall, so will the income tax you will have to pay on the gains.

- WHO NOTIFIES CII?

If left to the investor, every investor would have a different opinion on inflation. So, rather than letting investors calculate CII on their own, the Central Board of Direct Taxes (CBDT) is responsible for notifying the CII every year in the official gazette.

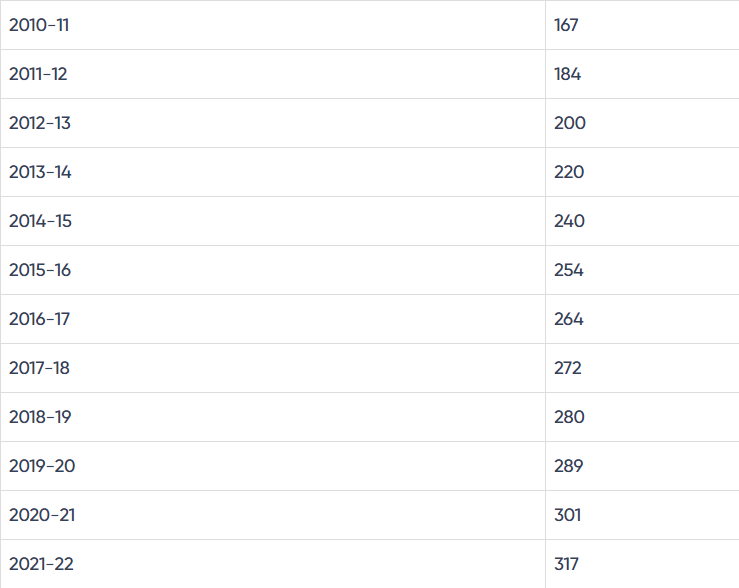

The CBDT calculates the CII and comes up with a unique three-digit number, which is then considered for calculating the indexed cost of assets.

- WHAT IS THE CURRENT CII?

CII has a base year concept. For instance, if the base year is considered as 1981, it will be treated as the first year of CII and will have an index value of 100. This index value of 100 will then be used for calculating the CII for the following years.

1981 was the base year for CII calculation in the past. The base year has now been shifted to 2001.