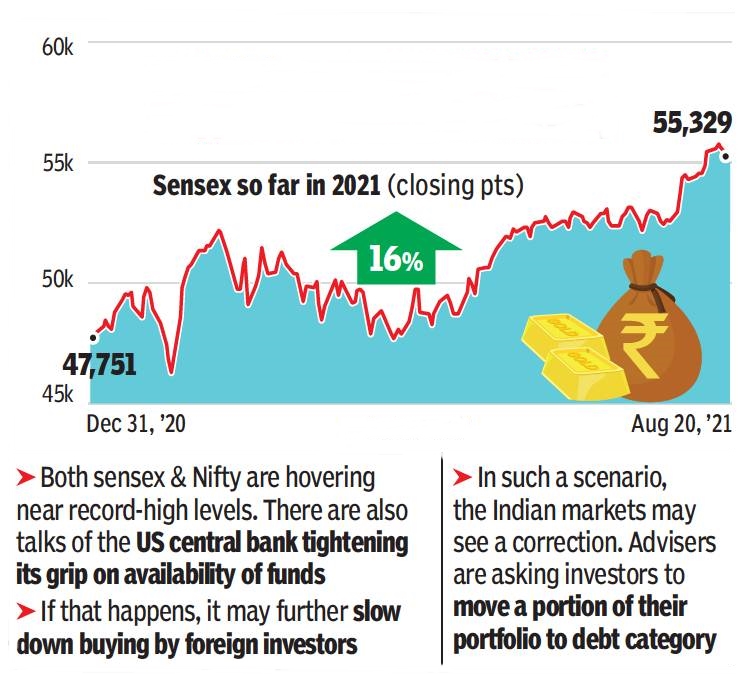

Leading indices have been scaling fresh highs on a regular basis. This is luring hordes of new investors to enter the stock market, expecting to make some quick gains. Behind the euphoria, however, there are chances that this feel-good-situation may not last long and inexperienced investors may have to face tough times.

Seasoned financial planners are advising clients to slowly shift their equity portfolio, at least a part of it, towards debt.

In the current over-exuberant times, lay down a reasonable limit for yourself and start paring your equity exposure unmindful of where anybody else expects the markets to go.

Financial Planners want investors to move their funds into less volatile fixed income assets rather than stay invested in equities and incur losses in case the market enters into some strong corrective phase. There are some reasons for financial advisers and market veterans to expect a correction during this ongoing bull rally. For one, the US central bank has been pumping in money into the global economy since the time the current pandemic started. Most of the major central banks around the world are also following the same path, trying to support their country’s struggling economy back on track through fund infusion. But lately there are increasing signs that the rate of inflation is rising, which is forcing central banks to slow down fund infusions.

Experienced investors, taking the mutual fund route, however, could relax a bit. According to financial planners, those who are invested in equity mutual funds through the SIP route, they need not take money out of the market now, unless they need money for some reason.

According to them, SIPs help investors to average out the cost of acquisition of mutual funds units. So if the market falls and the net asset value of the fund the investor is invested in also falls, the investor stands to gain more units of the same fund for the same amount of monthly SIP.