As yields on safe securities have shrunk during the past few years, income-only investors have found themselves with a stark choice: Either stick with cash and high-quality bonds and reduce their standard of living, or venture into securities that promise a higher payout with higher volatility to boot

Originally conceived by financial-planning guru Harold Evensky, bucketing is an approach in which you segment your portfolio based on when you expect to need your money. Using buckets works particularly well for nervous retirees who are reluctant to hold stocks of any kind. Money for near-term income needs is parked in cash and short-term bonds, while money needed for longer-range income needs remains in bonds and stocks.

Bucketing helps retirees get away from the income-only mindset, which may not lead to an optimal outcome.

Given that many retirees will live for 25 or more years in retirement, the bucket approach provides a necessary dose of long-term growth potential, enabling a retiree to hold stocks as well as safer securities for nearer-term income needs.

Advisors have developed many kinds of bucket strategies. While some rely on three buckets, others use many more.

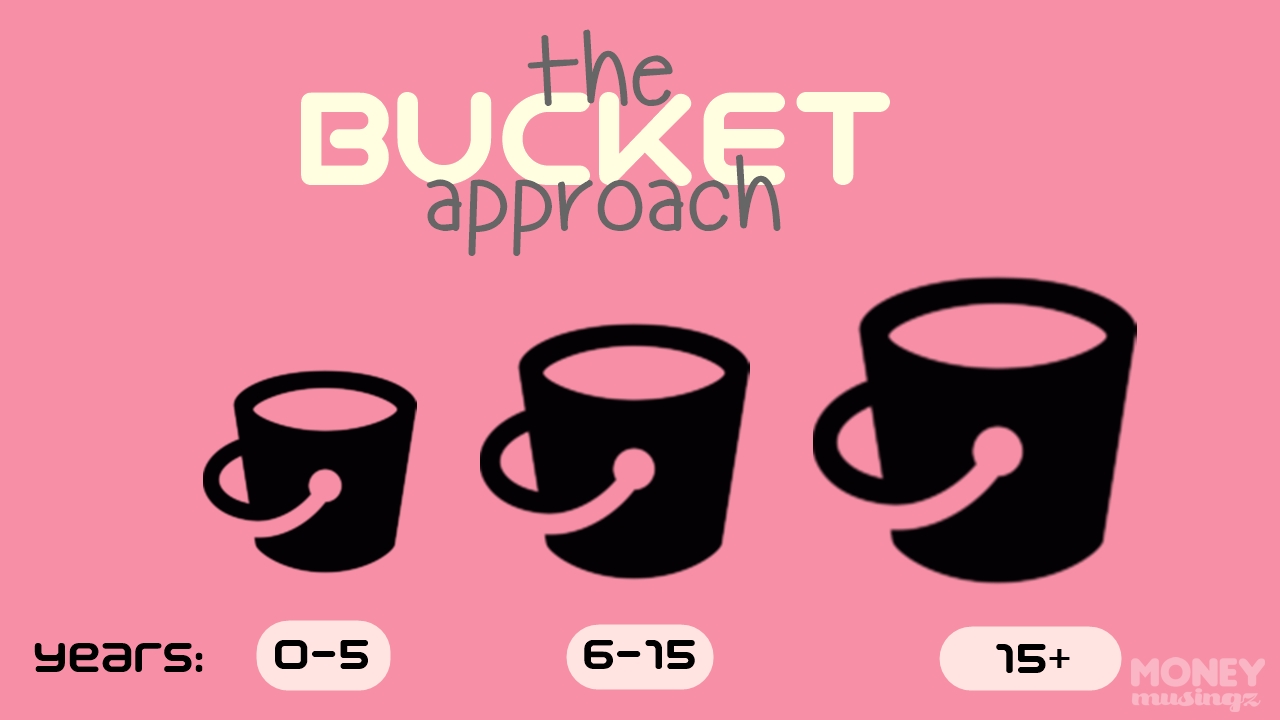

What is the three-bucket approach?

Simply split your retirement corpus into three pots – designated for your short, medium and long-term spending. The investments you hold in each bucket will differ in line with the time horizons.

Typical timeframes are:

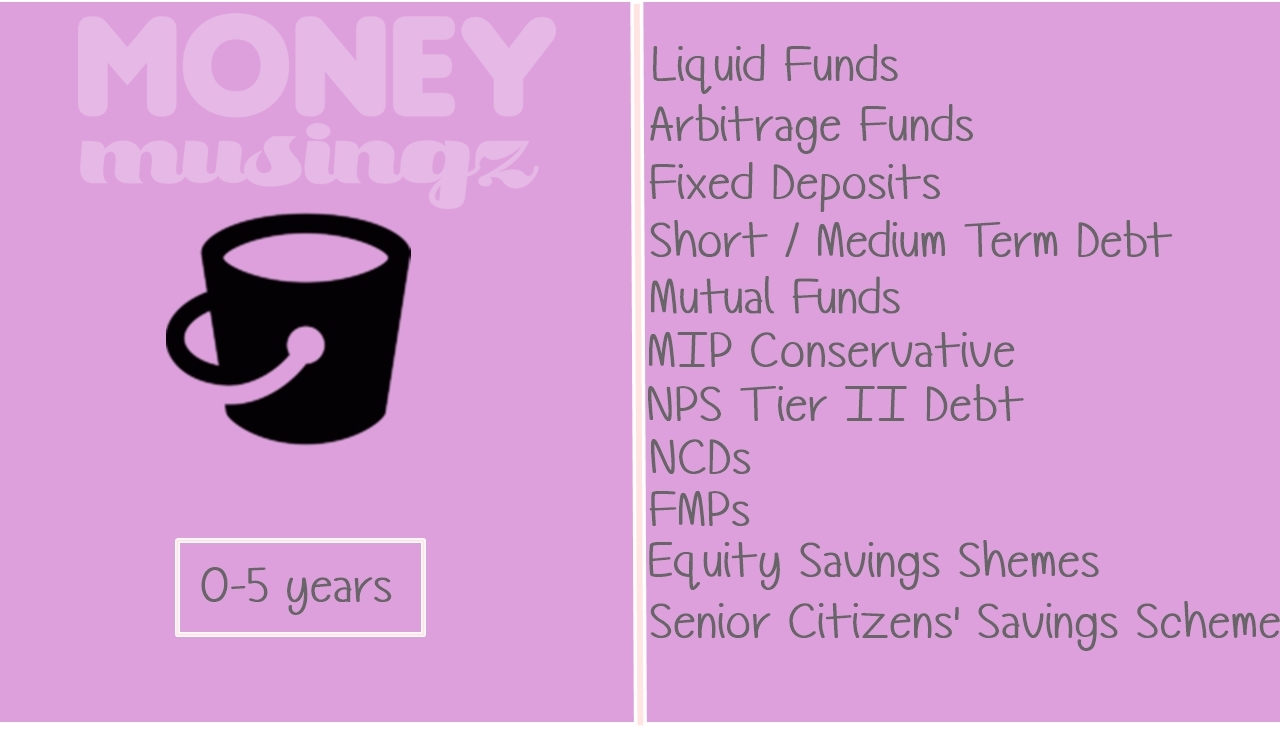

Bucket One: one to five years

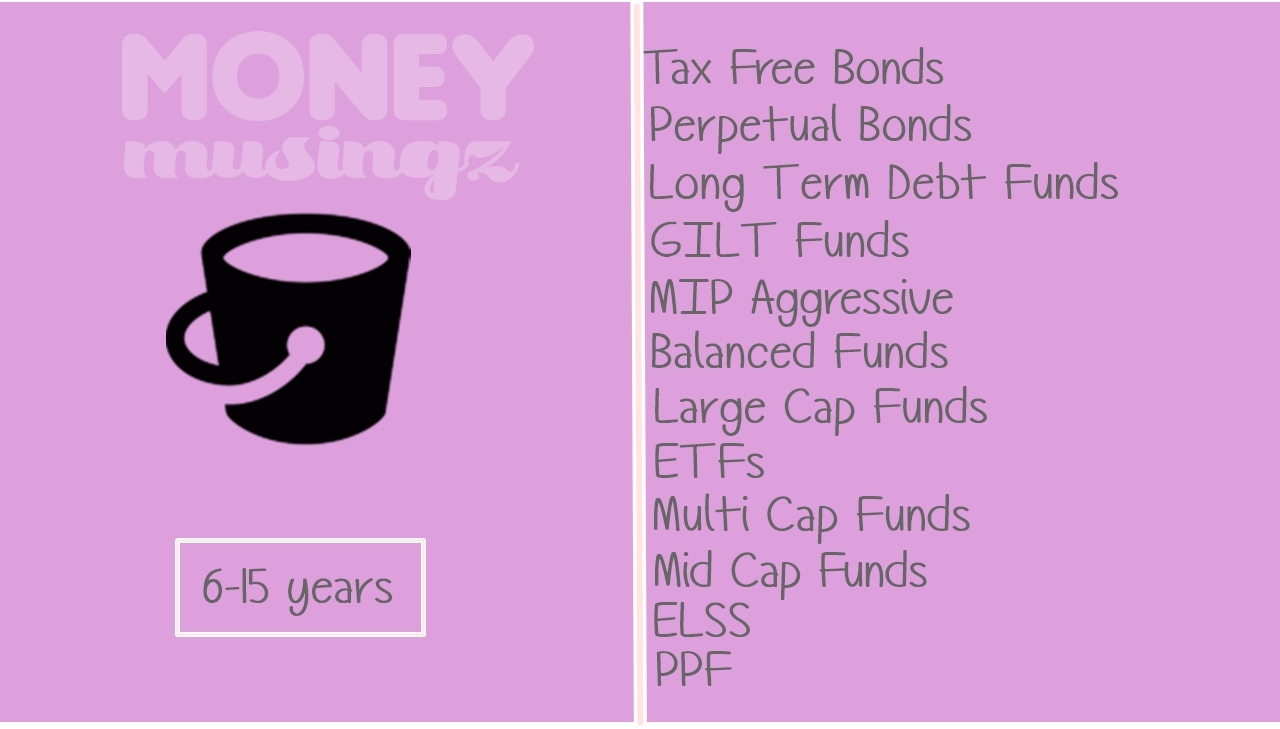

Bucket Two: five to 15 years

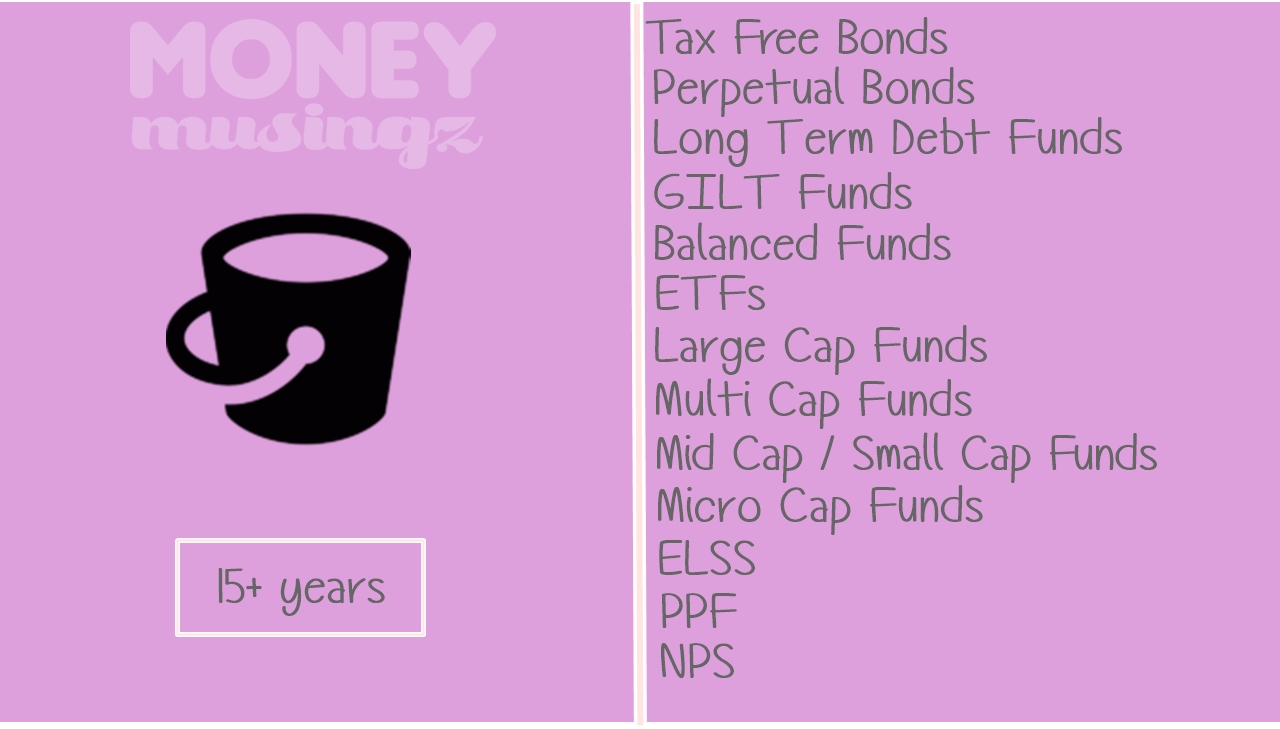

Bucket Three: for 15 years onwards.

The investment “risk zone” is the few years before retirement and while you are spending Bucket One. Rather than selling out of investments with the potential to generate long-term growth, consider investing your contributions in the few years before retirement in defensive investments and cash.

Holding a cash component (Bucket One) can help you ride out periodic downturns in your long-term portfolios without panicking. If you know your near-term income needs are covered in the cash and bond bucket—you’re likely to be less rattled the next time stocks plunge.

Money you need to fund in the mid-period (Bucket Two) could come from income-generating growth assets, such as high yielding equities. Such assets could also support you through the medium and even long term. Then you can gradually sell down your investments to make sure your money goes the distance.

When it comes to Bucket Three, don’t forget that the longer your time horizon, the more risk you can take. There is merit in considering a decent proportion of growth assets in your third bucket, the one that has 15 years to grow and/or recoup any losses.

Bucketing is flexible. A bucket portfolio can incorporate many of a retiree or pre-retiree’s existing holdings, and a bucket plan can be readily customized to suit a retiree’s own specifications.

For example, an older retiree with an expected 10-year time horizon might have just two buckets—one for very short-term needs and another bucket earmarked for the medium term. A younger retiree with a longer time horizon, meanwhile, might have similarly positioned short- and intermediate-term buckets as well as a sizable equity bucket for long-term growth.

Some analysts quibble with the bucket approach. While putting cash into buckets may make clients feel more secure, the strategy may not actually make portfolios safer. In the traditional 60-40 portfolio, all the assets are working to deliver returns. But if you set aside a big cash stake in a bucket, then part of your portfolio is not hard at work, and the expected returns of the portfolio will be lower.