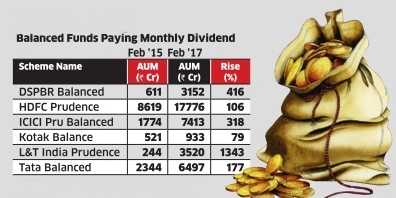

Balanced funds, which pay investors a monthly dividend, have seen their assets under management surge over the past couple of years. These funds have been able to dole out tax-free yield of 8-12%, which is much higher than what FDs and debt products offer, making the former very attractive. HDFC Prudence Fund has seen its corpus jump 106% from Rs.8,618 crore to Rs.17,775 crore, while ICICI Pru Balanced Fund has seen its corpus rise 318% from Rs.1,773 crore to Rs.7,413 crore and DSP Blackrock Balanced Fund has seen its assets rise 415% from Rs.611 crore to Rs.3,152 crore.

Over the past year, these balanced funds have been giving a monthly dividend, which translates into a yield of 8-12% for investors.

Balanced funds have anywhere between 65% and 80% invested in equities, with the balance in fixed income instruments. Since balanced funds invest more than 65% in equities, they are treated as equity funds from the tax perspective and the dividend is tax-free for investors.

HDFC Prudence Fund introduced the monthly dividend option in January 2016, while ICICI Pru Balanced Advantage Fund has the option since 2013 and ICICI Pru Balanced Fund since June 2015.

Financial planners caution investors that there is no guarantee of these dividends being paid out on a continuous basis, as a fund will have to realize profits to book dividends.

Investors looking for regular cash flows would be better off opting for a systematic withdrawal plan, as there is surety of cash flow.

Also read: https://moneymusingz.in/balanced-funds/