Additional Tier 1 bonds, also called AT1 in market parlance, are a kind of perpetual bonds without any expiry date that banks are allowed to issue to meet their long-term capital requirement. That’s why these bonds are treated as quasi-equity instruments under the law. RBI is the regulator for these bonds.

AT1 bonds are like any other bonds issued by banks and companies, which pay a fixed rate of interest at regular interval. Usually, these bonds pay a slightly higher rate of interest compared to similar, non-perpetual bonds. However, the issuing bank has no obligation to pay back the principal to investors.

These bonds are listed and traded on the exchanges. So if an AT1 bond holder needs money, he can sell it in the market.

Investors cannot return these bonds to the issuing bank and get the money. This means there is no put option available to its holders. However, the issuing banks have the option to recall AT1 bonds issued by them (termed call option). They can go for a call option five years after these are issued and then every year at a pre-announced period. This way the issuing banks can give an exit option to AT1 bond holders.

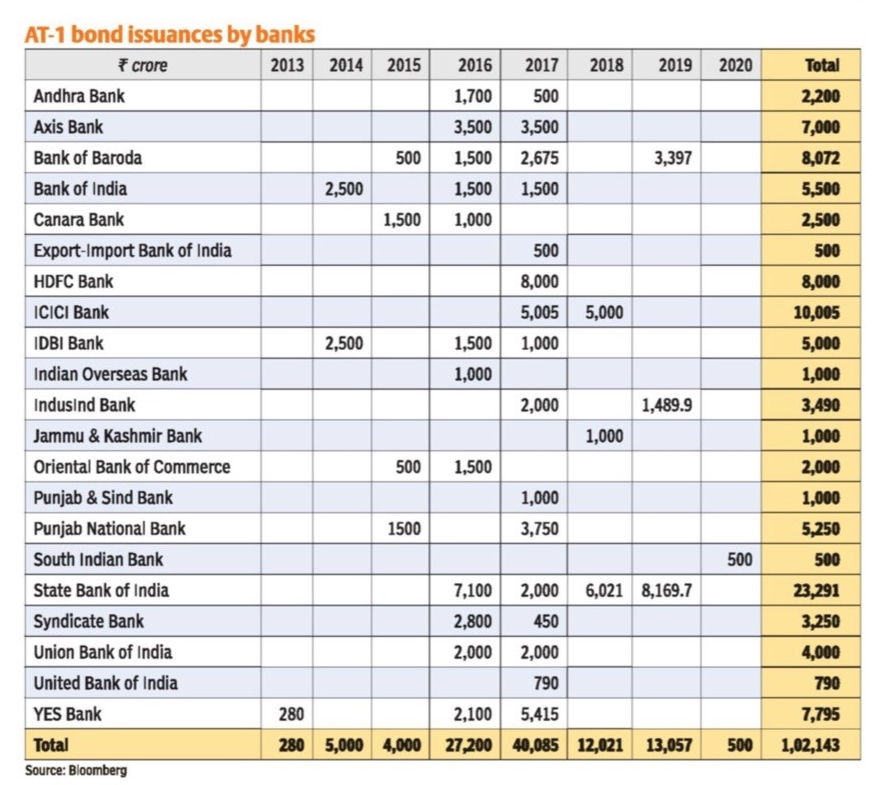

According to a report by rating agency ICRA, nearly Rs.94,000 crore worth of AT1 bonds are currently issued by various banks. Of this, Rs.55,000 crore is from PSU banks, while the balance Rs.39,000 crore is by private lenders.