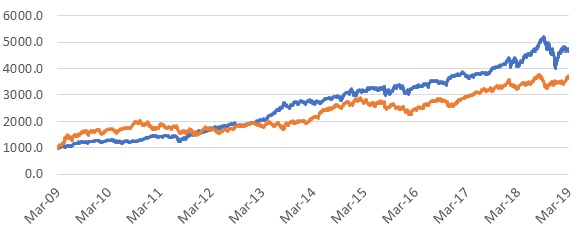

The blue line represents the S&P500 while the yellow line represents the Nifty50. Both the returns are calculated in Indian Rupee terms.

During this period, in INR terms, the S&P500 delivered a total return of 16.9%, while the Nifty50 delivered a total return of 14.1%.

An allocation to US equities would have benefited the portfolios of most Indians.

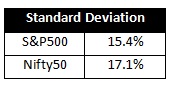

This higher return naturally leads to the question of whether the higher returns were accompanied by higher risks. The mathematical measure typically used to compare risks of two portfolios is the standard deviation representing one measure of volatility.

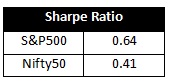

The S&P500 delivered the higher returns with much lower standard deviations, i.e. it was lower risk, higher return portfolio. Naturally, the Sharpe ratio of the S&P500 was also higher. The Sharpe ratio represents the risk-adjusted returns of a portfolio.

S&P500 has a Beta of 0.03 relative to the Nifty50. This means S&P500 is completely non-correlated with Nifty50. It is a great diversifier to an Indian equities portfolio! Addition of S&P500 to an Indian portfolio would reduce the relative volatility of the portfolio significantly, i.e. the beta as well as the standard deviation.

The addition of well-selected US equities to an Indian portfolio could provide higher diversification, lower risks, lower volatility, and higher expected returns.

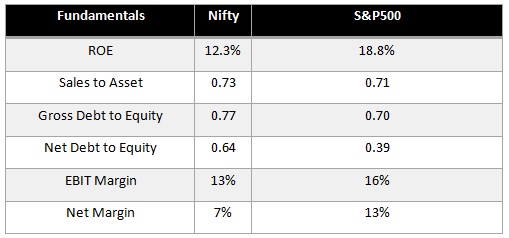

Take a look at the fundamentals of the US markets vs the Indian markets.

The Return on Equity of the US market is much higher than the Indian market. It is clear that the US companies enjoy stronger moats and can invest shareholder capital at higher returns as compared to the Indian companies. This is all the more interesting given that Indian companies operate in a high-inflation environment and thus are helped with a higher base rate of return.

The sales to asset ratio is similar between the two markets and shows that the amount of sales generated from investments in assets is similar across the two markets. So a rupee of assets would generate around 0.7 to 0.8 rupees of sales for both the markets.

The gross debt levels in the Indian markets are slightly higher but not significantly so. However, the net debt, i.e. gross debt adjusted for cash on the books, clearly shows that the US companies are much less leveraged and have much higher levels of cash and liquidity as compared to the Indian companies. This provides a strong footing for them to survive any potential economic downturns.

Further, the operating margins are also superior for the US companies signifying that they are managing their costs more efficiently and probably have better pricing power.

The net margin differences which are very large are the result of the lowered tax rates that the US companies now enjoy.

The fundamentals indicate that the US companies are facing fundamentally lower risks, higher efficiency and can potentially invest the shareholder capital at much higher rates.

Thus the fundamental and portfolio risks are lower with the S&P500 portfolio as compared to a Nifty50 portfolio. However, there are a few risks the Indian investor in US equities should be aware of.

Unfamiliarity with US economy, markets and companies is the main risk that the Indian investor faces. This can be remedied with more exposure and reading on the US markets. Over a period, the readings and subsequent familiarity would lead to more understanding and appropriate responses to market movements without resorting to panic-driven responses which are typical when one invests in unfamiliar instruments or asset classes.

Another risk over the near-term is the rupee appreciation risk. In the short-term of 0-3 years, the rupee can appreciate vis-à-vis the dollar and hence some returns from the S&P500 would be cancelled out.

However, the data is clear that over longer periods of time, the rupee depreciates due to the large differences in inflation between the two countries. This adds to the returns from S&P500 and is favourable. However, investments for short horizons, i.e. less than 3 to 5 years are exposed to both higher markets risks and currency risks.

All the above numbers though aren’t an argument to make wholesale switches in your portfolio from Indian equities to US equities. If you’re an optimist (and a contrarian), you may well believe that the next ten years will be very different for the Indian market than the previous ten years. The dollar may lose its mojo and the rupee regain it, the domestic business cycle may lift off and take the stock market with it. Or corporate earnings may get back to 15-20 per cent growth, helping Indian equities outperform. But if you’re just a little bit sceptical about all this and would like to buy some insurance for your portfolio, parking 10 per cent of your portfolio in US equity funds is a great idea.

Please analyse, possibly in consultation with your financial advisor, whether such an addition of US equities suits your needs and risk profile.