Oil and Natural Gas Corporation has been one of the worst-performing index stocks in recent years though it still remains part of the Nifty50, India’s most popular and traded index.

The BSE has, however, ejected ONGC from the Sensex.

ONGC’s market capitalisation is down 65 per cent since the beginning of 2015 due to a combination of a sharp fall in crude oil prices and its bloated balance sheet, which is now saddled with debt of over Rs.1 trillion. The drilling firm had the third-highest market capitalisation at the end of December 2014 and now it is ranked 24th.

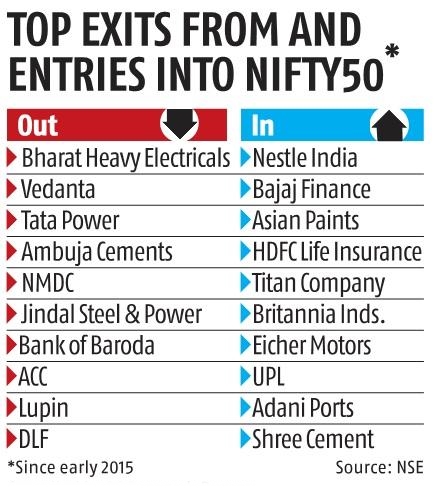

The fall of ONGC has been part of a broader decline of commodity producers and industrial and infrastructure companies in the past few years. In the past five years, 13 companies in the commodity and industrial space have exited the Nifty50.

While in the US, the likes of Exxon Mobil have been replaced with tech and internet firms, in India its equivalents have lost out to lenders and consumer companies.

Some of the high-profile exits from the index in the past five years include those of Bharat Heavy Electricals, once the country’s top capital goods maker; Vedanta, the country’s top non-ferrous metal producer; and Tata Power, the largest power utility in the private sector. Other firms include National Mineral Development Corporation, Lupin, Punjab National Bank, Ambuja Cement, ACC, DLF, Jindal Steel & Power, IDFC, and Cairn India. These were replaced with companies such as Asian Paints, Britannia Industries, Nestlé India, Bajaj Finance, Bajaj Finserv, HDFC Life Insurance, Titan Company, Adani Port, Shree Cement, and JSW Steel. With a few exceptions such as Shree Cement and JSW Steel, new entrants are largely from consumption-oriented sectors such as low-ticket consumer goods, retail finance, and insurance.

The recent movement in share prices of index stocks suggests a greater churn lies ahead because commodity and infra firms that remain in the index — such as NTPC, Adani Power, Coal India, Tata Steel, Larsen & Toubro, Hindalco Industries, M&M, Tata Motors, and Bharti Infratel — continue to underperform the broader market by miles.