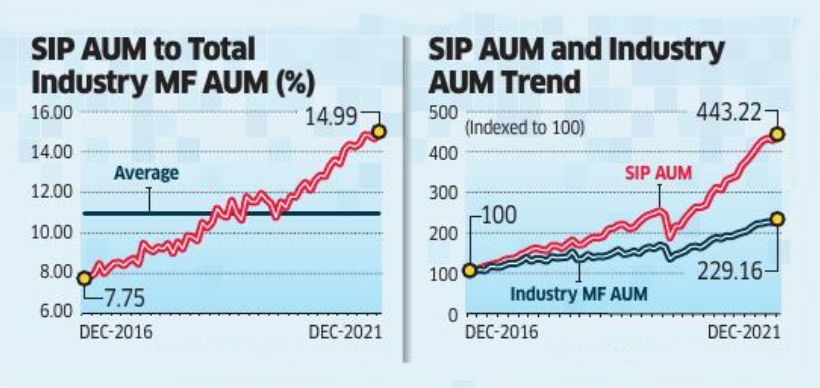

The share of assets under management of the funds linked to SIPs reached a record 15% of the AUM of the mutual fund industry in December 2021, data from the Association of Mutual Funds in India (AMFI) show. The SIP AUM grew by 34. 6% annually in the past five years compared with the 18% growth in the total MF AUM.

At ₹5. 6 lakh crore, the SIP AUM was nearly a quarter of the AUM of equity MFs and 2% of the total market capitalisation of Indian equities. According to industry estimates, nearly 90% of SIP inflows are deployed in the equity funds.

In 2021, the SIP-linked funds saw an inflow of ₹1. 1 lakh crore. The SIP monthly book size expanded in each of the eight months to December.

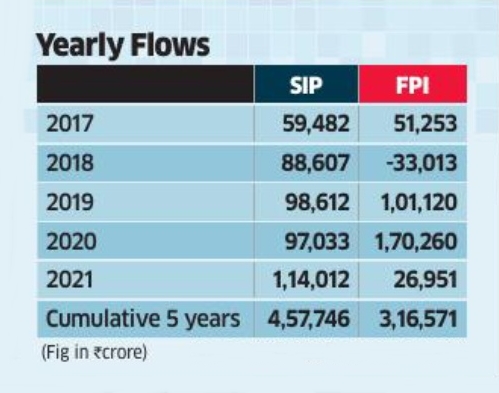

In the past five years, the cumulative SIP inflow was ₹4. 9 lakh crore, 1. 6 times higher than the flow of foreign portfolio investors. Average ticket size of an SIP investor was ₹2,303 per account and its portfolio value was about ₹1. 2 lakh at the end of December 2021.

Equity MFs had a strong inflow of ₹41,906 crore in the December 2021 quarter. Of this, 30% was mopped by new fund offerings.

Consequently, the retail AUM including equity, hybrid and solution oriented funds, touched ₹ 18. 3 lakh crore.