According to a concept paper by Sebi, “A credit rating is an ‘opinion’ on the creditworthiness or the relative degree of risk of timely payment of interest and principal on a debt instrument…a rating indicates the probability of default of the rated instrument and therefore provides a benchmark for measuring and pricing credit risk.” In simpler words, credit ratings indicate the probability of a lender or depositor to the instrument getting back the money, with interest and within the mutually agreed time-frame and policies.

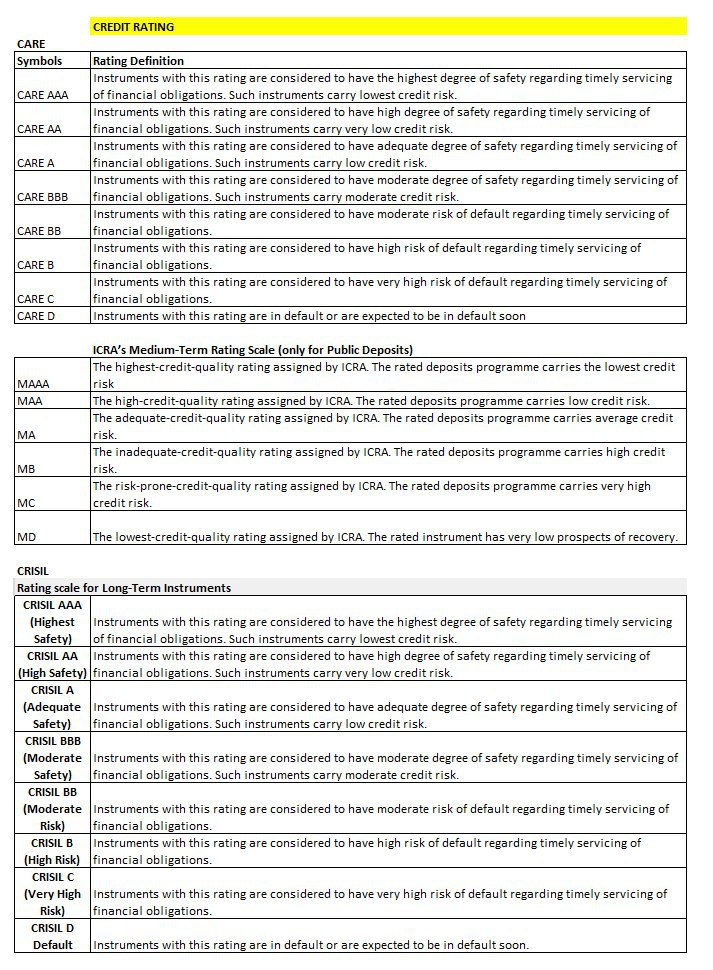

Typically, credit ratings for companies and financial instruments are assigned in alphanumeric combinations like AAA or AA+. Typically, instruments rated AAA are considered to have the highest degree of safety regarding timely servicing of financial obligations. Such instruments carry the lowest credit risk.

The Sebi concept paper says that in India, credit ratings started with setting up of Crisil Ltd (formerly The Credit Rating Information Services of India) in 1987. Now Crisil is a division of S&P Global. Apart from Crisil, there are a few more Sebi-registered rating agencies in India. These are: ICRA Ltd, CARE Ratings, India Ratings and Research, and Brickwork Ratings India.

These rating agencies rate various financial instruments as mentioned earlier. Besides that, in many cases, issuers of financial instruments are also required to get credit ratings from two different credit rating companies for the issue. However, a high rating does not mean a ‘buy’ investment advice; there are other factors to look at as well before investing. Moreover, credit rating assigned to an instrument initially, at the time of offering, may change over time. There are many instances when highly rated corporate fixed deposits of a company got downgraded over time, based on a reassessment of the company at a later date.