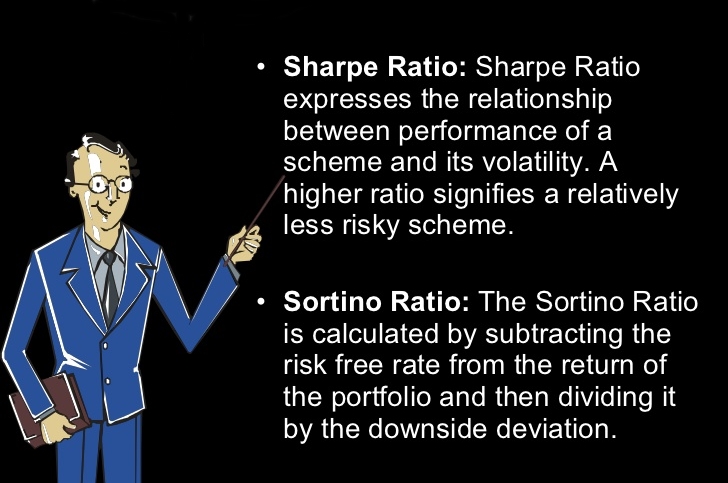

Sortino Ratio measures the risk-adjusted returns of a given scheme. This ratio is suited well to conservative retail investors. In plain terms, sortino ratio gives a clear picture of how successfully a scheme’s fund manager has been able to cap downside volatility of a scheme -its returns falling below average returns, and put up encouraging returns. This makes sense for retail investors as they are more concerned about downside risks of their investments. A key aspect of sortino ratio is it specifically focuses on downside volatility of a scheme.

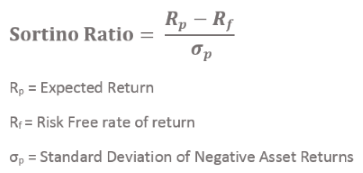

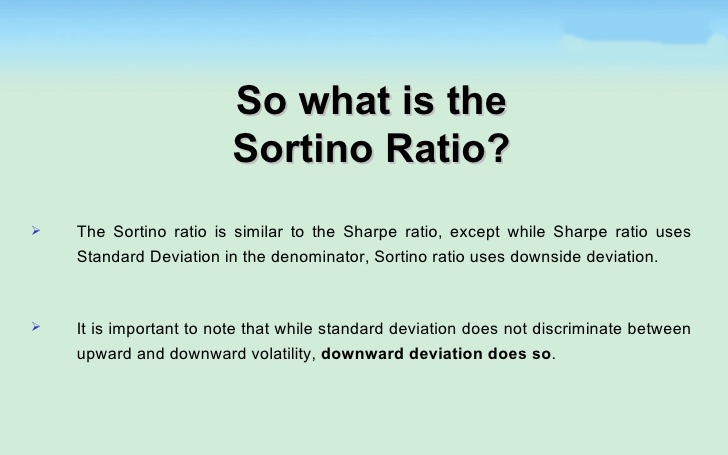

Sortino ratio is named after Dr.Frank Sortino of Pension Research Institute, US. One of the key reasons there is an increasing acceptance for sortino ratio is it gives a pragmatic picture of the downside risk associated with a scheme. Instead of using standard deviation , sortino ratio uses downside deviation in the denominator. It is computed in this fashion. It deducts the risk-free return from the portfolio’s returns and then the number obtained is divided by downside deviation. Higher the sortino ratio, lower is the probability of downside deviation.