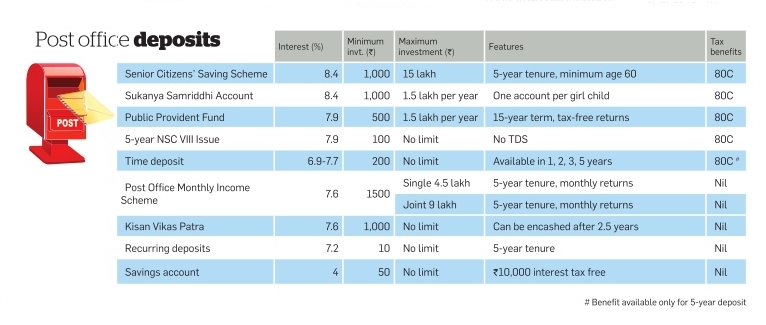

The government has lowered interest rates on small saving schemes like PPF, Kisan Vikas Patra and Sukanya Samriddhi scheme by 0.1% for the April-June quarter, a move that would prompt banks to cut their deposit rates.

For April-June, these have been lowered by 0.1% across the board compared to January-March. However, interest on savings deposits has been retained at 4% annually. Since April last year, interest rates of all small saving schemes have been recalibrated on a quarterly basis.

A finance ministry notification said investments in the PPF scheme will fetch lower annual rate of 7.9%, the same as 5-year National Savings Certificate. The existing rate for these two schemes is 8%.

Kisan Vikas Patra investments will yield 7.6% and mature in 112 months.

The one for girl child savings, Sukanya Samriddhi Account Scheme, will offer 8.4% annually, from 8.5% at present, while it will be the same at 8.4% for the 5-year Senior Citizens Savings Scheme. The interest rate on the senior citizens scheme is paid quarterly.

Term deposits of 1-5 years will fetch a lower 6.9-7.7% that will be paid quarterly while the 5-year recurring deposit has been pegged lower at 7.2%.