Stop Repenting, Sir! Jump into Fabulous India’s Equity Train

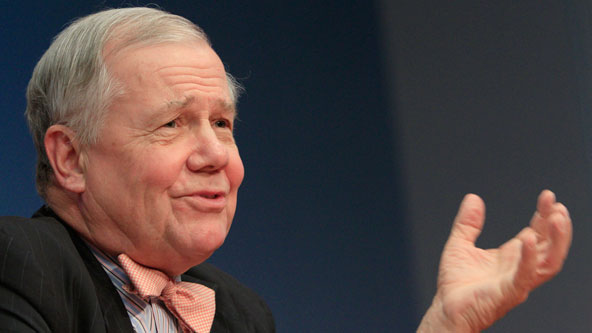

Dear Jim,

Ours is a one-way relationship. I had written you an open letter in 2015 when you had profoundly declared to exit the Indian equity market. In your recent interview, you have understandably regretted that decision. I wish you had read my letter and acted upon it, as by now you would have more-than-doubled your wealth in USD terms by investing in Kotak Emerging Equity Fund with a nominal leverage.

I am writing this letter to present facts that have been overlooked by you.

`The Indian Equity markets are at an all-time high’

It is half-truth to say that equity markets are at all-time high. Numerically, Sensex is near an all-time high level, but from the valuation point of view, it is far away from the levels seen in bubble years of 1992 and 2000 or expensive valuations of end 2007. My recommendation will be to look at valuation, not numerical level of index.

We have made money for our unit holders for the past 20 years by investing even at times when markets were at an `all-time high’, as you like to say. We could do it as we were focused on stocks. Many years ago when HDFC Bank got listed, R K Damani, a legendary Indian investor, bought it aggressively not only at all-time high prices but also at very high valuations. Someone asked him why he was buying HDFC Bank at such high price valuation. His golden reply was: “Dharavi (a slum area of Mumbai) is Dharavi and Peddar Road (an upmarket area of Mumbai) is Peddar Road.“

The bottom line: You can make money by picking up good stocks and giving them time to deliver. Equity investing is like growing a tree. Find a good seed, plant it in right place, nurture it well and wait for it to deliver delicious fruits.

`I am not aware of any big steps to boost FDI’

I am sure you are aware that India has become the largest recipient of FDI in the world overtaking China in FY 17. You might not be aware that our FDI numbers don’t include retained earnings like in China. Global FDI investors are undoubtedly turning positive on India because they can see success stories, such as Maruti. As you may know, Maruti is a subsidiary of Suzuki Motors. Maruti has outperformed Suzuki shares in USD terms since its listing by more than 12 times. This is despite Suzuki owning 53% of Maruti and receiving royalty from Maruti. Maruti now has become bigger than Suzuki in market cap creating tremendous wealth for its shareholders including Suzuki. FDI investors are coming to India because of positive experience of corporates like Nestle, Unilever, Suzuki, Bosch, Glaxo, LG, Samsung, Citi Bank, Pfizer, Cummins, P & G, Timken, Cognizant, Accenture, IBM, Abbot and Facebook etc.. Don’t go by what Snap Chat CEO Evan Spiegel talked about India. He will soon eat his words like Tommy Hilfiger. We treated Uber much more favourably than your favourite country where they had to make a hurried exit in favour of a homegrown company .

`I don’t want to jump into a moving train. When you jump into a moving train, you get hurt’

For the last 20 years, I have advised my investors that you must jump into equity train irrespective of whether it is standing or running. There are chances that you might get hurt if you catch a running train. But time will heal all your wounds. What is more important is to be on the train rather than waiting on the platform for the next train to arrive. My recommendation will be to take some risk and get the thrill of catching a running train. It will be equally joyful like your bike ride around the world.

`India still has lot of debt unlike Russia which has a low debt and a convertible currency . Indian debt-to-GDP ratio is high at 90%’

Our debt-to-GDP ratio is currently 69% down from 84% in Mid-2000. Our credit-to-GDP ratio is one third of Chinese official number. We couldn’t create enough credit to push growth as we were obsessed with currency notes. We kept 12% of GDP in currency notes restricting creation of credit through velocity of money . We completed world’s largest demonetisation exercise recently . These will move cash from currency in circulation to bank deposits helping create credit to support accelerated growth. Our rupee is fully convertible for foreigners. In my industry , numerous FDI and FII investors have taken their money out even at the depth of US sub-prime crisis in 2008. We have never put any restriction on selling of stocks and repatriating money like your favourite country did in 2015. You will be reassured to know that for more than 5,000 years, we have never defaulted to any foreigner.

`Will invest in India if government makes the currency convertible and opens up the market’

Our currency is fully convertible for foreigners as explained earlier. We have an open market as we follow the maxim of “Atithi Devo Bhava“ Guest is God. If you don’t believe me, please show me one country which has welcomed FDI and foreign trade like India. In the listed space, our largest bank, insurance company , FMCG company etc. are majority owned by foreigners. Almost half of our listed free float is owned by foreigners. Our ability to open economy can be linked to your ability to accept our labour as we have surplus labour and you have surplus capital. Shouldn’t there be a level-playing field whereby you take our labour and we take your capital?

`I invested, but Modi did nothing much for two years, and then I sold’

Let me list out a few things, which the Modi government has done since May 2014, which will have a positive bearing on the Indian economy in days to come.

We were using energy-guzzling incandescent bulbs. The Modi government launched a programme to provide energy-efficient LED bulbs to save power.Their bulk purchase reduced prices of LED bulbs by about 90%. India will be saving 20,000 MW of power annually by 2019 when we distribute about 770 million bulbs. You are well aware of the leakages in the subsidy distribution. The Modi government scaled up Aadhaar which is a biometric identification like your Social Security Number to remove ghost recipients from food and fuel subsidies. These steps are helping the country save about $4 billion annually.

There are more than 10 million Indians who have voluntarily given up their cooking-gas subsidy to enable the government to provide subsidised cooking gas to rural households. Health benefits to rural woman who were inhaling smoke from wood and coal daily in absence of cooking gas are beyond financial analysis.

In India, 70% of goods move by road making it an expensive and time-consuming affair. Several steps are being taken to move cargo by the railway and the water route. Dedicated Freight Corridor is a game-changing project under implementation. It will improve speed of a goods train from about 25 km to about 75 km and cargo carrying capacity from 1,300 tonnes to 5,000 tonnes. These 3,380 km of railway track will connect Northern India to Western and Eastern India reducing cost of transportation. Similar steps are taken to connect Eastern and Western India through the sea route through Southern India. Hyundai now uses the sea route to transport automobiles from Southern India to Western India reducing transportation costs.

Our annual import of coal averaged about $17 billion between FY11 to FY14 despite having sufficient coal reserves. In FY15, we incrementally produced more coal than previous four years. In the past, our power plants faced shortage of coal. Now, they face the problem of storage of excess coal. India is expected to stop importing thermal coal by 2019. Jobs, which we were helping create in Indonesia, South Africa and Australia, are now being created in India. I am sure that as a commodity guru, you will be aware of these as it has brought down global coal prices.

The world is moving towards a digital architecture. Many developed countries are allowing private companies to build architecture and create billions of dollars of market cap. In India, we are creating digital architecture in public space like UPI, Aadhaar, BHIM etc, and making it available at a nominal cost. I will recommend you to read an article written by your peer macro investor Raoul Pal on digital transformation of India.The benefits of digital transformation of India are not yet discounted by the market.

We annually spend about $7 billion to provide employment to rural people through a programme called MGNREGA. Now, this programme is used to deepen existing water bodies and developing new water bodies. In last two years, we have developedcleaned 1 millionplus water bodies, which will help in recharging ground water and improving farming. The benefits of such developments are not yet reflected in the Indian agriculture and rural economy or markets.

I will need entire newspaper to write about the work done by the Narendra Modi government. It is not that they have done everything right. The government has to take steps to resolve NPAs in banking sector, revive private-sector investment, improve ease of doing business and create millions of job.

Our economy and markets will go through ups and down. It is possible that our markets can correct from the current level. However, for a long-term patient investor, India will remain a good opportunity .

I strongly recommend you to jump in the moving train and be part of the fabulous India Growth Story. I am sure you won’t be regretting that decision in future.

Yours truly, Nilesh Shah

P.S: My apologies if you find this letter unwarranted. You are far more senior and elder to me in age and stature. My intention is to make you aware about the correct situation of India.

The following is the 1st open letter written by Nilesh Shah to Jim Rogers, following an interview he gave……

Dear Jim (Rogers),

Our relationship is one way. I have heard you a few times in person and seen many times in print. You may not know me but I am a part of a team that has given 7 times more returns in dollar terms than Berkshire Hathaway has over the past 17 years. We have beaten the benchmark index by double the margin of Warren Buffett’s outperformance since our company’s inception.

I read an interview by you on India…You made some profound statements. I am taking the liberty of putting them in the right context.

“Stock market performance is not equal to India’s performance.” I completely agree that India should focus on the economy rather than the market. India should focus on domestic investors and foreign direct investments (FDI) rather than hedge fund managers. It should not give undue attention to the market as it can run ahead of the economy on bullish sentiments and fall behind on bearish ones.

“I had bought shares in India—it was one of the few times I’ve done that in my life, and it was because of the new government.” India should, in fact, have been part of your core portfolio. While many banks in your part of the world trade at prices first seen in the early 1990s, the BSE banking index in India has risen 19.45% compounded annually in the past 10 years. You would have made far more money if you were an investor in India rather than a trader. I urge you to consider investing in equity mutual funds as most of us are outperforming the benchmark indices by large margins.

“First, get rid of exchange controls and make it easier for foreigners to invest in India.” Please show me one market where the largest bank, mutual fund, telecom company, or consumer staple company is majority owned by foreigners. Easy access to India is demonstrated by the fact that foreigners now own more than half of the free float, in just about two decades. India also permits investments through participatory notes (P-notes). Even when the stock market had hit a bottom in 2008 or when the rupee had depreciated sharply in mid-2013, foreign institutional investors (FIIs) had full freedom to take their money out. While we do have some taxation issues, there are no exchange controls for foreigners. You should actually be asking India to enforce exchange control rules, unless you are long on Swiss banks.

“I still own Indian shares, and I wonder if I should continue holding, because, after a year of no action, you begin to wonder if anything is going to happen.” It will be unfair to judge India based on headlines. Many economic and qualitative parameters have shown significant improvement over the past 12 months. Let me narrate a few instances to show that things have started moving.

A road contractor who had bid for a national highway project through an e-tender told me he got the letter of intent in three hours by e-mail. The government plans to spend four times more than last year on building roads. I met an iron ore miner who said that iron ore mining is likely to begin in Odisha in the near future, and may boost domestic production by more than 20%. Many coal mines will also become operational post-auctions. A railway contractor told me that railway orders have started flowing with transparency in tendering. I met a power equipment supplier who mentioned that public sector units have started giving orders.

“I bought Chinese shares last week, even though it was going through the roof. The risk at this point in China is that it looks like there is a bubble developing.” Chinese markets, having doubled in 12 months, are probably a bit overvalued. Their government is trying to cool down markets that were boosted by the cheap and easy leverage to domestic investors. India has outperformed China by more than two times in dollar terms over the past 15 years. It will only be fair to say that China and India both need to be part of your core investment portfolio.

“Rating agencies rarely get it right about anything.” Rating agencies have indeed been unfair to India. Despite the longest track record of non-default, we get much lower rating than deserved.

“I am not saying he is great—all central bankers are bad—but, he is certainly the least bad.” This statement is wrong. Central bankers in India do a good job. They manage conflicting objectives of stable rupee, improving growth, controlling inflation, maintaining banking stability and managing government’s borrowing programme. Many comment on our system without understanding the scale. When our Railways moves more than the population of Australia every day on its network, it has to be evaluated on separate benchmarks.

“I own gold. But I’ve constantly said I am not buying gold. I expect another opportunity to buy gold sometime in the next year or two.”

Gold prices are supported by Indian consumption. We have spent more money in importing gold, silver and diamonds than FDI and FII inflows in the past five years. The government has announced gold deposit and lending schemes along with stringent laws against black money. If executed well, these schemes can reduce Indians’ craze for gold. If India stops importing gold, you can guess where gold prices will go.

I have always found it better to invest in golden entrepreneurs. Since the inception of the Sensex in 1979, it has outperformed gold by more than 21 times in dollar terms.

India is changing with newer and better business models. There will be many winners and a few losers. Don’t go by the headlines. Do your own analysis. When I heard you for the first time at a mutual fund award function years ago, you mentioned that one should invest in orange juice and sugar. I bought Indian sugar stocks, which multiplied far more than physical sugar’s price. Most of the times, it makes sense to listen to all but to choose your own path.

Your well-wisher,

Nilesh Shah.

The author is managing director, Kotak Mahindra Asset Management Co. Ltd.